GBP’s performance in January was stronger than we had expected on a combination of less immediate tail risk from Brexit(following outline political agreement in December over a stand-still transition once the UK leaves the EU next March until end-2020) and a more supportive central scenario for the economy and monetary policy. Of the two, a reduction in the Brexit risk premium appears to have been the more significant.

Nevertheless, the modest acceleration in UK growth to around 2% doubtless contributed to the reversal of speculative positioning in GBP from heavily short to heavily long (more so CTAs than macro investors we believe) as it led to a firming up of UK rate expectations (one and a halfhikes are now priced for the end of 2018, three and a half by end-2020) and the promotion of GBP to the vanguard of currencies where central banks are in the early stages of policy normalisation.

GBPJPY has been spiking more than 38.2% Fibonacci retracements in the consolidation phase in the major declining trend. However, one month has been enough to wipe-off previous 5-months’ rallies (refer monthly plotting for February’s price slumps). This shows the intensity of the major declining trend.

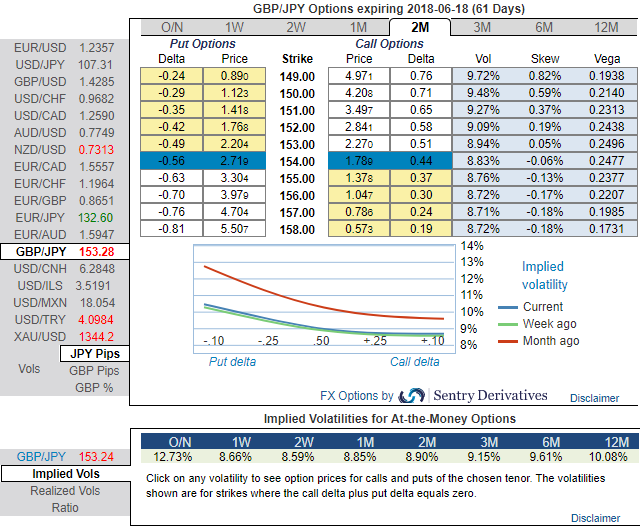

To substantiate this bearish stance, let’s glance at the positively skewed IVs of GBPJPY of 2m tenors still signify the hedgers’ interests in OTM put strikes (upto 149 levels) and isn’t this a luring factor for a shrewd bear. While 2w/2m IVs of ATM contracts are trending above 8.59% and 8.90% respectively that are the suitable combinations for diagonal ratio spreads structures.

Because the higher IVs with well-adjusted positive skewness signify the hedgers’ interest for both OTM call/put strikes. In usual circumstances, long option position needs higher IVs for significant change in vega. Hence, we capitalize on buzzing IVs in 2m tenor for long leg and improve odds on options below strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility. Thus, ATM strikes are perceived to be more conducive than the OTMs.

Further GBPJPY upswings and/or weakness suggest building directional strategies as given below and volatility patterns at the same time.

1) In order to mitigate the mounting downside risks and keep them on the check, we advocate adding longs in 2 lots of (1%) OTM -0.49 delta puts of 2m tenor while writing 1 lot of 1% ITM put of 2m tenor. Payoff structure of this strategy has been exponential as the underlying spot FX keeps dipping (refer above payoff table).

Contemplating IV skewness and ongoing technical trend, we foresee the value of ATM options would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

2) Dubious and risks averse traders, we advocate buying GBPJPY – USDJPY 1Y ATM straddle spread with equal JPY vega.

3) Alternatively, on hedging grounds, we advocate shorting futures contracts of near-month tenors as the underlying spot FX likely to target southwards 145 levels in the near run and 146 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data