The US labor market report today is the first important indication of how the second wave of Covid-19 pandemic is affecting the economic recovery in the US. It is generally expected that the rise in employment has slowed considerably in July. However, there is significant uncertainty as to how much it has slowed. Certainly, the ADP report, which signalled only roughly 170k new jobs in July following 2.4 million the previous month, was not a good indication. On the other hand this particular indicator has not been very reliable recently so that today’s data entails considerable potential for a surprise to the up- and downside.

The GBP has risen against the weaker USD but is prone to disappointment as UK-EU trade talks are deadlocked. The US dollar has risen modestly overnight but remains close to recent range lows against both the euro and sterling. The pound was supported by a Bank of England statement that seemed to suggest that a near-term move to negative interest rates was unlikely. It has slipped back below 1.3150 against the US dollar this morning.

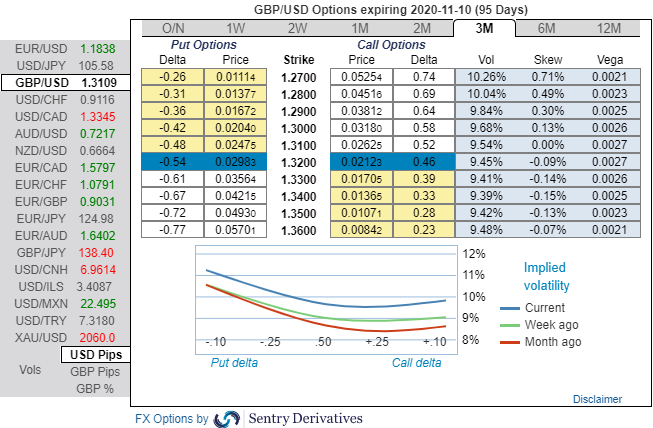

Options Strategy (Debit Put Spread): Contemplating above factors, we wish to deploy diagonal options strategy by adding short sterling: Stay short a 2M/2W GBPUSD put spread (1.3210/1.27), spot reference: 1.3109 level.

The Rationale: Observe the 3m GBP’s positive skewness that has stretched towards OTM Put strikes upto 1.27 levels, hence, options traders are expecting that the underlying spot FX to slide southwards.

While risk reversal numbers have still been signalling bearish hedging sentiments in the long run. One can observe fresh positive bids to the existing bearish setup that indicates hedgers have still positioned for bearish risks in the months to come amid abrupt spikes in between. Capitalizing on rallies to write OTM puts will reduce the cost of long leg.

Hence, we advocate the diagonal options strategy on both hedging and trading grounds. Courtesy: Sentry, Saxo & Commerzbank

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts