GBP has delayed the imminent sell-off risk via several upside breaks, but this appears to be only postponing the looming setback.

The GBPJPY has been volatile, edged higher briefly to just shy above $139 after bottoming out at 123.298 level in mid-May, as the reports of a Brexit deal agreement also cushioned the bulls. Currently, trading with little exhaustiveness due to pandemic turmoil coupled with Brexit saga back in action, still, it is well up from last week’s lows.

Even so we reckon that it worthwhile increasing our bearish beta to GBP through re-selling GBPJPY (our single most successful trade to date this year).

On Friday, UK monthly GDP figures will provide the most comprehensive indication yet of the economic impact of the lockdown. Output in April is expected to have fallen by a staggering 20% with activity in the industrial sector, construction and services all forecast to be down sharply. Survey data point to the likelihood of a further, albeit smaller, drop in output in May as the lockdown continued for almost all of the month.

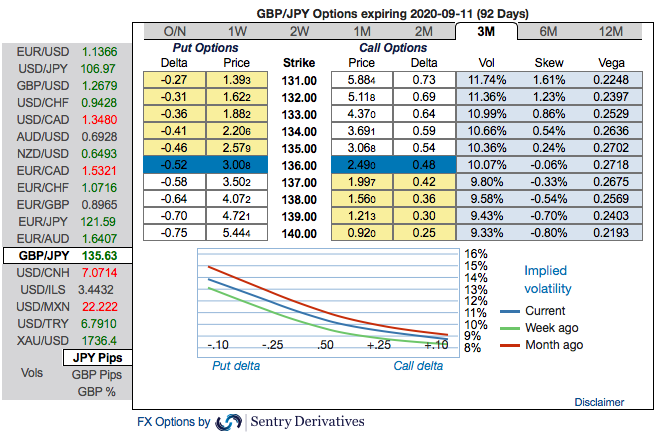

GBP/JPY OTC outlook and Hedging Strategy: The implied volatility of this pair that display the highest number among entire G7 FX universe.

While the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 131 levels (refer above nutshell).

Accordingly, put ratio back spreads (PRBS) are advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on current abrupt and momentary price rallies and bidding theta shorts in short run, on the flip side, 3m skews to optimally utilize delta longs.

The execution: Capitalizing on any minor upswings , we advocate shorting 2m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options (spot reference: 135.760 levels while articulating). The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement.

In addition, we advocated shorts in futures contracts of mid-month tenors alternatively with a view to arresting potential dips, since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for July month deliveries.

While on trading grounds, buy GBPJPY 2M ATM straddle vs Sell GBPUSD 2M ATM straddle, equal notionals. Courtesy: Sentry, Lloyds & JPM

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential