The resurgence in political risks as coup’s fall-out escalates political risk has returned to Turkey with a vengeance, with negative domestic developments unfolding at break-neck speeds in the aftermath of Friday’s failed military coup attempt.

Already, Moody’s has warned Turkey on Monday that it may downgrade the country’s sovereign credit rating to non-investment grade, citing the adverse impact of political developments on growth, on the integrity of institutions, and on Turkey’s external vulnerabilities. Moody’s August 5th review date looms.

Meanwhile, the Central Bank of Turkey (CBRT) has demonstrated that it prioritizes political signalling and domestic growth over financial stability considerations, leaving Turkish assets exposed to the risk of a repeat of the financial turmoil experienced in January 2014.

Long USDTRY, targeting 3.2888, we recommend a long USDTRY position via below option strategy, which is currently trading at 3.0418. Our trade horizon is 2-3 months. We target an 8% move higher in USDTRY to 3.2888, and if you want to initiate the longs in the spot then place a stop loss at 2.9234. The position costs 70bp in carry per month.

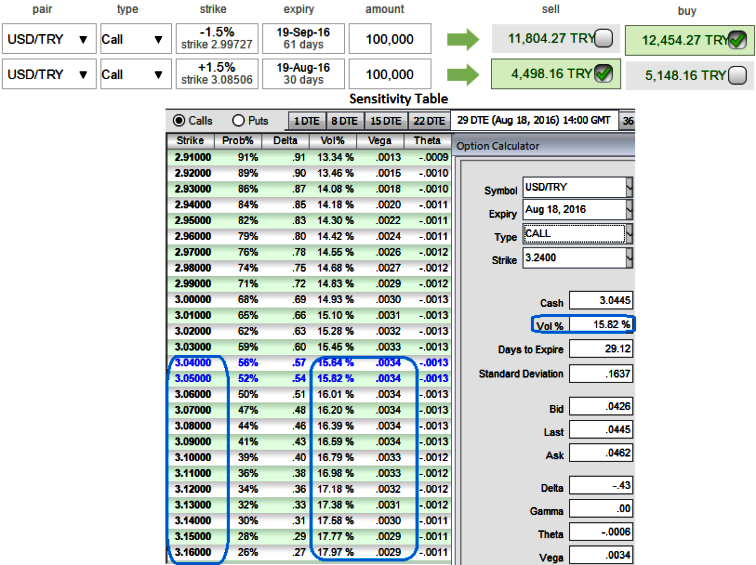

Hedging Strategy of USD/TRY: Diagonal Spread

1M ATM implied volatility of USDTRY is perceived to be at 15.82% and it is likely to creep negligibly lower in the long run (for next 6 months to 1-year span).

While OTM put strikes with higher probabilistic numbers have healthy vega with rising IVs.

TRY among few EM currency space typically held in carry basket seems cheap on a real effective exchange rate basis, buy 2M USDTRY (1.5%) ITM calls vs short 1M (1.5%) OTM delta calls, use European-style options.

Please be noted that the strategy reduces the hedging cost approximately by 25% as you can observe from the diagram, as USDTRY drifts below spot ref: 3.0418 but remains above 1.5% ITM strikes within next one month, then the strategy constructed above is likely to fetch positive cashflow on expiry, but use tenors as accurately as stated above (the expiries used in diagram are for demonstration purpose only.

Fundamental risks for the strategy:

Efforts to bolster democracy and restore investor confidence may undermine the recommended position Efforts by President Erdoğan to re-establish social cohesion and uphold democratic ideals while avoiding a shift toward autocracy would likely help to revive market confidence, leading to declines in USDTRY. Emergency measures by the CBRT to tighten its monetary stance or limit TRY liquidity may also help TRY to strengthen, thereby undermining the trade. Periods of EM-favorable risk sentiment may also help TRY to appreciate.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms