The strategy: We've already advocated this strategy in our earlier post. Stay firm or initiate longs in USDSGD 3m one-touch knock-in 1.4950 on below strong grounds of fundamental attributes that are explained below, indicative offer: 20% (spot ref: 1.4354).

The one-touch option has a binary payoff of either zero at expiry if the barrier level is not reached, or the notional amount if the 1.4950 barrier level is triggered at any point over the 3m tenor.

The maximum leverage is 5 times. Alternative structure: For investors who prefer a cheaper structure, a USDSGD 3m European digital strike 1.4950 costs only 12% (leverage of 8.3 times).

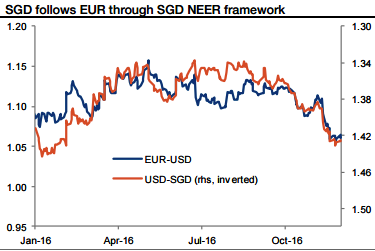

Tracking EUR to parity: As stated before, in Q1’17, the EURUSD has broken through the technical support at 1.05 which is line with the projection, during this quarter this should maintain below this level and to reach parity (Trumped up changes). We previously provided trade recommendations for a significantly lower EURUSD (EURUSD -Dipping or taking a deep dive?). If the pair does indeed test 1.00, USDSGD should rise towards 1.50.

Correlation is strong: The SGD trades with a very strong correlation to the overall dollar cycle. It has been tightly linked to the EURUSD in the past year and the relationship should hold going forward given the SGD NEER framework (refer above graph).

Low implied volatility within EM: The SGD has one of lowest implied vols in EM (3m implied volatility at 6.7%, against 10.0% for the EURUSD), making it relatively cheap to express a directional USD view through options. We expect overall EM currency volatility to increase in coming months alongside a stronger dollar

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed