The primary motivation for these trades was poor European growth momentum as also reflected in the weak flash PMIs, which was expected to weigh on cyclical economies with strong links to regional growth. Thus, EURGBP shorts have been recommended in part due to carry and in part due to global growth apprehensions and the recent Brexit developments that have kept us bullish.

Soft regional growth continues to be a dominant concern for the Euro bloc. Following the abysmal Euro area flash PMIs to substantiate, while the activity data has continued to disappoint and the economic activity surprise indices are negative in the Euro area. The economists’ growth forecast revisions have been negative as well over the past quarter (for the Euro area and Scandis).

Amid the prospects of an interim US-China trade deal as well as increasing possibility a Brexit deal in the run-up to the October 31st deadline, we see EURGBP’s interim price dips are momentary and it is wise to capitalize on them to deploy longs in the long-run.

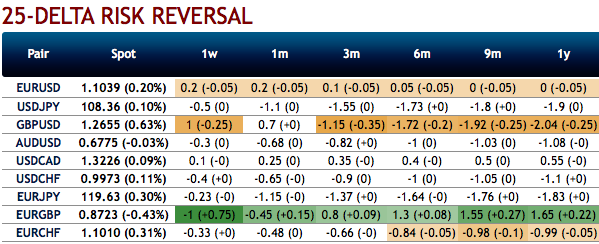

Let’s now quickly glance through OTC outlook before looking at the options strategies. Fresh positive numbers are added to bullish risk reversals of EURGBP. This is an indication of the broader hedging sentiment for the bullish risk outlook in the FX OTC markets, this is interpreted as the hedgers are keen on bullish risks but with the mild downside risk sentiment in the near-term (refer to negative risk reversals in 1m).

While the passively skewed IVs of 3m tenors are stretched are indicating upside risks, more bids are observed for OTM call strikes up to 0.92 level.

While EURGBP risk reversals of the existing bullish setup remain intact with mild bearish shift, you see minor negative risk reversal numbers, but it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid the expected turbulent condition.

According to the OTC FX surface, 3-way options straddle versus ITM calls are advocated seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Options Strategy: The strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short (1%) ITM calls of 1w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks.

Alternatively, on hedging grounds we advocated initiating directional hedges that comprised of shorts in EURGBP futures contracts of September’19 delivery and simultaneously, longs in futures of December’19 delivery for the major uptrend, we wish to maintain these positions.

We wish to maintain the same strategy by rolling over short-leg of October delivery, while the long-leg remains intact. Courtesy: Sentrix, JPM & Saxobank

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty