It is likely to surprise many that the euro has not come under more pressure as a result of the renewed government crisis in Italy. The two factors are playing a key role here:

Firstly, the market is likely to have got used to the political drama in Rome to some extent, in particular as each time so far the crises did not have any far-reaching market-relevant consequences. Also during the most recent episode of budget disagreements, the EU Commission refrained from starting an excessive deficit procedure in the end.

Secondly, the euro is benefitting from the current market environment. Fears of a global recession have caused a flight into safe havens, and amongst them is the euro - even if it might benefit to a lesser degree than the more popular safe havens like the Swiss franc, Japanese yen, and US dollar.

In principle, the single currency is nonetheless appreciating, as a glance at the trade-weighted euro exchange rate is illustrating. In addition, BTP spreads have widened but in view of the rally on the bonds markets, even Italian yields are at such low levels that fiscal concerns are not really justified from the market’s point of view - a stroke of luck for the euro.

OTC Updates:

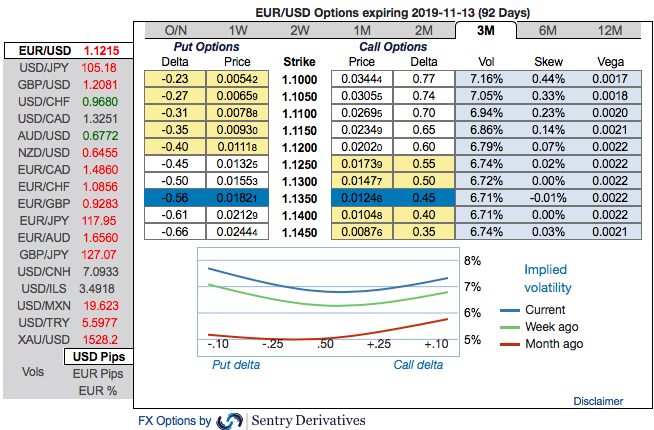

The FX OTC hedging markets are also suggesting the same thing, the IVs and risk reversals of the short tenors indicate interim rallies but the major bearish hedging sentiments remain intact.

Volatility traders perceptibly expect only about what is likely to and what actually turns out. As you could observe the above nutshell, 3m positively skewed IVs are stretched on either side (equal interest in both OTM call and OTM puts) that signifies hedging sentiments for both upside and downside risks.

To substantiate these indications, positive shift in longer tenors but bearish neutral RRs (risk reversals) across all tenors, which is in line with the above-stated bearish scenarios.

Options Strategies:

All these indications coupled with the fundamental news and the underlying scenarios are attractively appealing ITM put holders. Contemplating all these factors, we advocate below options strategy.

Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write a (1%) out of the money put option of 2w tenors.

Alternatively, the dubious bulls but with hedging grounds can also deploy 3m 1% in the money puts with attractive delta. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.Courtesy: Sentrix, Saxo & Commerzbank

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts