Although the potential for a near-term pullback of Kiwis dollar to the 0.6500 area is lingering, followed by a resumption of the three-month old rally beyond 0.6750 upon a positive outlook for the NZ economy in 2020, the major downtrend remains intact as the global risks are expected to persist. Especially, Chinese growth and trade are going to get trauma owing to disastrous & contagious coronavirus attack.

NZDUSD after failure swings at 0.6733 level, it has shown -4.04% losses in the previous month and dropped below 0.65 areas, the prevailing cushion at 0.6435 looks vulnerable.

We expect NZDUSD to grind lower this year, projections are at 0.62 levels by the end of H1’2020. The cyclical cocktail for NZD includes a somewhat more supportive global backdrop, but tightening domestic financial conditions that will require more action from the RBNZ. Our central forecast for 2 more RBNZ cuts would see rate spreads vs USD hit historical extremes, though the exchange rate will be insulated to an extent by a still elevated terms of trade, as well as balance of payments positives as the local earnings of Australian parent banks are retained under the RBNZ’s new capital regime. Hence, the potential for a near-term pullback to below 0.63 area.

OTC Updates and Hedging Strategies:

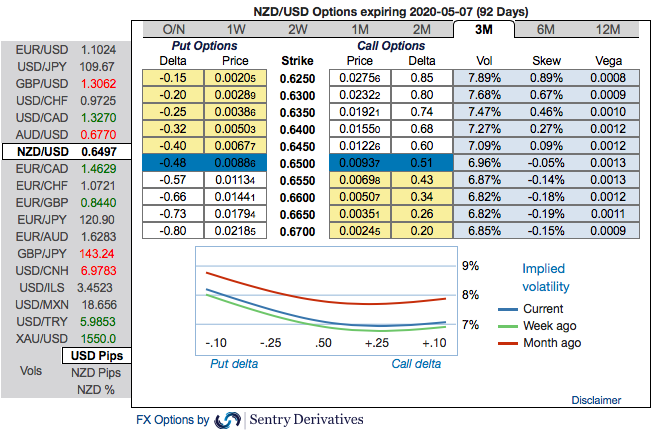

Let’s now quickly glance through OTC updates before deep diving into the strategic frameworks of NZDUSD. The pair is showing moderated IVs among G10 FX bloc (3m IVs are in between 7.20-8.15%).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

The skewness of 3m IVs signals extreme downside risks, bids for OTM put strikes are quite visible (upto 0.6250 for these tenors). Based on above-mentioned fundamental factors and OTC outlook, diagonal debit put spreads are advocated ahead of RBNZ monetary policy that is scheduled for the next week, the strategy is designed to mitigate the downside risks with a reduced cost of trading.

The execution: Short 1m (1.5%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options capitalizing on the minor upswings in the short-run.

Alternatively, we recommend directional hedges that comprised of longs in NZDUSD futures contracts of February’20 delivery, simultaneously, shorts in futures of March’20 delivery for arresting bearish risks in the major trend. The short leg is likely to hedge potential slumps and the momentary upside risks can be arrested by the long leg. Thereby, one could be able to directionally position in their FX exposures on hedging grounds ahead of RBNZ and US non-farm data numbers. Courtesy: Sentry & JPM

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target