Today, euro-focused views are visible in the markets as the series of data announcements are lined-up, with the highlight being the ECB policy announcement at 12:45BST and press conference starting at 13:30BST. During the morning, Eurozone GDP and CPI inflation figures, as well as German unemployment claims, will be released.

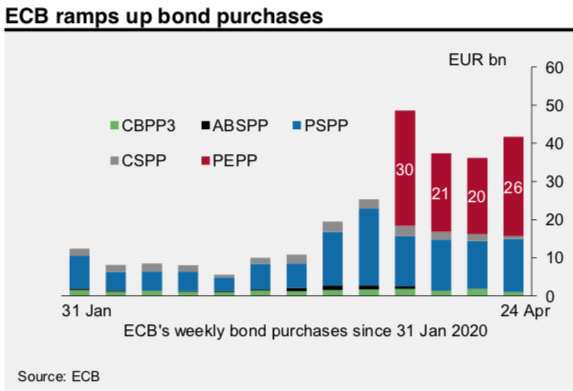

The main event is the ECB policy decision. Interest rates are expected to be left unchanged, while the ECB has already committed to buying €1.1 trillion of bonds this year, including €750bn in the new Pandemic Emergency Purchase Programme (PEPP) covering both public and private sector securities. Nearly €100bn of bonds under the PEPP has been bought in the past four weeks (refer 1st exhibit).

We remain short EURCHF as a dual trade on the unfolding global depression and the potential second- round effects for Euro area cohesion and debt sustainability. As the 2nd chart details, the CHF NEER continues to behave in keeping with its historic pattern - appreciating both in the lead-up to the crash (unlike USD and JPY) and in the immediate aftermath.

SNB unsurprisingly posted a record quarterly loss of CHF 38.2bn in 1Q20, which equates to a 4.6% drawdown on its total foreign asset base. While the sum is of course material, it is unlikely to have particularly pronounced consequences for the conduct of the SNB’s future FX operations. The SNB had an effective capital base of CHF 163bn at the start of the year, which was split between its revaluation reserves (CHF 79.1bn) and its distribution reserves (CHF 84bn). The 1Q losses eat thus up one quarter of this capital cushion but this nevertheless leaves the SNB with a capital cushion of CHF 125bn, equivalent to is 15% of its total foreign assets. This ratio of capital to foreign assets is well above the low of 9.5% reached in 2016 following the de-peg. The upshot is that the SNB’s balance sheet remains relatively robust despite the 1Q drawdown (refer 3rd chart).

The more relevant issue for future SNB intervention is not whether the central bank has the financial capacity to intervene, it does, but whether the SNB is willing to risk US censure from intervening on a scale that could cause the UST to cite it as a currency manipulator. The SNB releases its balance sheet for March at the end of next week - hopefully this will shed more light on the uptake of the SNB;s new domestic liquidity facility and hence how much of the CHF 41.5bn increase in sight depos since the start of March is in fact attributable to SNB FX intervention. The UST's threshold to indicate potential FX manipulation - sustained FX purchases exceeding a 2% annual rate – equates to CHF 14bn in Switzerland’s case.

Trade tips: Short EUR/CHF from 1.0577. Marked at +0.48%.

Alternatively, on hedging grounds, activated shorts in EURCHF futures contracts of mid-month tenors when it trading was 1.0722 levels, it fetched desired results, current spot reference: 1.0562 levels, we wish to reactivate these positions with May’20 tenors. Courtesy: JPM

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action