The euro was able to catch up significantly over the past few days (refer above chart). Despite the fact that numerous positive news items should be supporting the dollar: the stock market is booming; consumer confidence is approaching the peaks recorded at the start of the millennium and today’s revision of Q2 GDP data is likely to confirm strong growth of around 4% annualised. Even the Fed has provided positive news as with Richard Clarida an expert was confirmed by the Senate as Vice Chair of the Fed. He is generally viewed as being competent and is expected to support Fed chair Jerome Powell’s path of gradual rate hikes. Nonetheless the dollar was unable to appreciate recently with the exception of the days of the lira crisis when it was in demand as a safe haven.

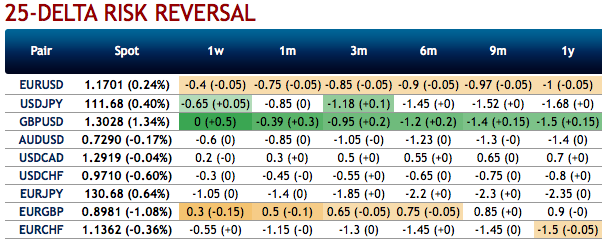

OTC Outlook: Please be noted that the positively skewed IVs of EURUSD of 1m tenors signify the hedging interest of bearish risks.

While RR numbers of 1w expiries show mild bullish shift in the short-term, whereas bearish risk sentiment remains intact in the long-run (refer long-term risk reversal numbers).

Well, contemplating above-stated driving forces and OTC indications, options strips strategy is advocated on both trading as well as hedging grounds. The options strips strategy which contains 3 legs needs to be maintained with a view to arresting price downside risks.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bullish (in near-term) and bearish technical environment (in long-term) and most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers.

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 1M tenors, go long 1w at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 18 levels (which is neutral), while USD is flashing at 28 (which is bullish), while articulating at (13:24 GMT). For more details on the index, please refer below weblink:

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary