The US market would be closed today due to it being Martin Luther King Day and there are few economic data releases. The main event this week would be the ECB, BoJ, and Norges Bank meetings, although neither the ECB or the Bank of Japan are expected to make any changes to their current policy stance. The Bank of Japan maintained its key short-term interest rate unchanged at -0.1 pct at its December meeting, even after the Federal Reserve raised rates for the fourth time this year. Policymakers also kept the target for the 10-year government bond yield at around zero percent and maintained their upbeat view on the domestic economy despite slowing growth in China, uncertainty from Sino-US trade dispute and volatile financial markets.

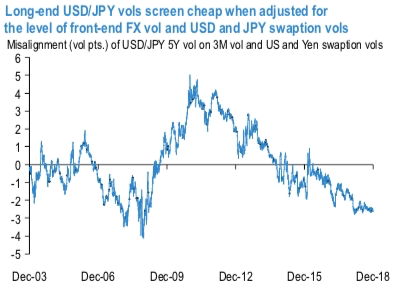

While subdued yen vol levels are moderately cheap, particularly at the long-end, when adjusted for the level of short-dated (3M) FX vol and USD and JPY interest rate volatilities (refer above chart) such that entry levels into strategic vega longs are reasonably attractive. It is true that JPMorgan’s forecast of 118 on USDJPY spot by mid-2019 – 4% above the current market is not conducive to higher yen vol when viewed through the traditionally inverse spot-vol correlation lens. Yet this disregards the change that has taken place in the Greek profiles of yen option books over the past few years due to corporate structures.

Since the advent of Abenomics in late 2012/early 2013 that turned around the post-GFC trend of steady yen strength, Japanese importers have been active buyers of USDJPY via net vol-selling structures such as knock-out (KO) forwards, with KO barriers set in a broad 125 – 140 zones depending on product vintage.

Though locally supplying vol to the street, these structures can swiftly lose vega if USDJPY were to approach 120, as option pricing models start pricing in some likelihood of structures knocking out; the reduced requirement to hold short vega hedges, as a result, can spur dealer demand for vol even in spot rallies. In other words, yen vol now boasts more of a two-sided, convex relationship with spot instead of the one-sided inverse link of the past, albeit it will require spot to break out of tight recent ranges in either direction to activate this more symmetric spot-vol correlation. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at -103 levels (which is bearish), hourly USD spot index was at 54 (bullish) while articulating at (07:13 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close