Long CHFJPY has been our top strategic pick for 2020 premised on the substantial difference in the underlying balance of payments position between the two countries.

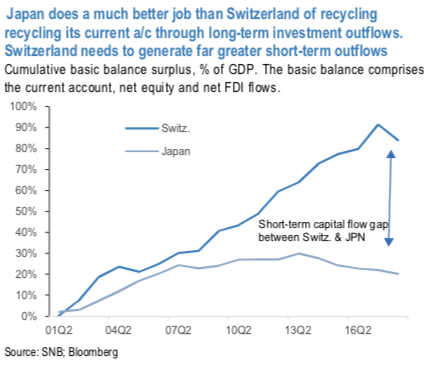

The bottom line is that Japan neutralises all of its current account surplus through outflows of long-term equity & FDI whereas Switzerland recycles only one-half in this manner (refer above chart).

In other words, Switzerland needs to generate substantially greater outflows of short-term capital than Japan. This not only biases CHF higher vs JPY on a trend basis, but also means that CHF could potentially hold its own versus JPY in risk-off environment. It’s fair to say that the thesis that CHF could prove more anti-cyclical than JPY has not yet been established (CHJFJPY has dipped a 1.5% in the last two weeks), so to be on the safe side we are buying JPY vs one of the most cyclical European currencies, SEK, to neutralise the possibility that we are could inadvertently find ourselves on the wrong side of a deeper shake-out in risk.

For now, therefore, while we are still short CHFJPY spot and are short CHF-JPY correlation through a dual AED, the net spot position now converts to long CHFSEK.

This off course is highly sensitive to growth and is well-placed to capitalise on a more substantive re- think of the regional and global economic outlook.

Sell SEKJPY at 11.268, stop at 11.493.

Long CHFJPY from 113.45 on Jan 14th. Marked at -0.83%.

Stay long a 2-month dual at-expiry digital (USDCHF < 0.9625 & USDJPY > 110.70). Bought at 10.5%. Marked at 2.52%. Courtesy: JPM

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics