Only a few analysts had expected the SNB to cut its key rate at today's meeting. But, the Swiss central bankers maintained the status quo in their monetary policy to keep rates unchanged at -.75%. However, another aspect of today's SNB decision is more interesting. The SNB eased the burden for banks that result from the negative-rates policy.

So far, the exemption threshold for banks' SNB deposits was 20 times the average minimum reserves of autumn 2014. Two adjustments have been made to this rule:

- The threshold factor has been increased from 20 to 25.

- And the reference period for reserves is now dynamic. It is the average of the last 36 reference periods and therefore will now reflect the rise in reserve requirements that occurred during the last five years - and the one that might come in the future.

That by itself is easing the burden on Swiss banks that results from the extreme negative-rates policy, which now exists for nearly five years.

Swiss franc (CHF) has been a relative underperformer this month, retracing about a quarter of its 6% May-August rally as risk sentiment has somewhat improved of late – but we remain bullish, OTC updates are also in sync with the projections:

Driving these moves lower were a few factors:

1) tentative signs of stabilization in activity data (as indicated by the headline manufacturing PMIs),

2) a restart of US-China trade talks with a small postponement of tariffs, and

3) clarification on the extent of policy easing that China will deliver. Still, these developments are far from fully resolved; the data has not clearly bottomed, and ongoing US-China uncertainty should continue to adversely affect the manufacturing complex, which should continue to weigh on growth globally and thus underpin CHF on a more medium-term basis.

OTC Updates and Options Strategies:

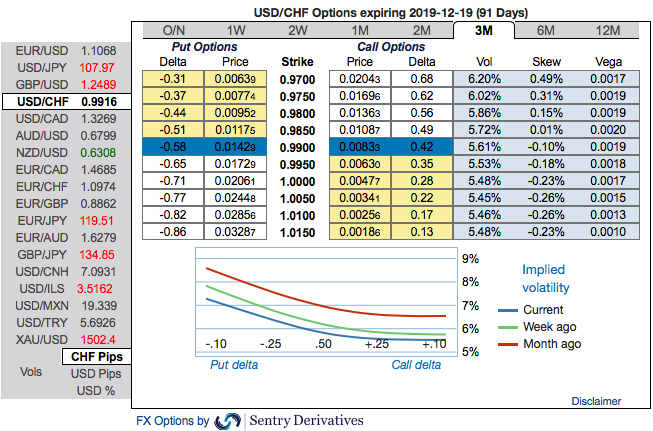

Let’s just quickly glance through OTC updates before deep diving into the strategic frameworks of USDCHF. CHF crosses are showing shrinking IVs among G10 FX bloc (1m IVs are at 5.4 for USDCHF). Butterfly options spreads are suitable amid this lower vols environment.

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

Most importantly, positively skewed IVs are still advocates of downside risks. Please also be noted that the minor positive shift in risk reversals (RRs) of across all tenors and bearish RRs of the longer tenors that are also in sync with the bearish scenarios refer 2nd(RR) nutshell.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

On trading grounds, executing below options strategy as IVs are most likely to favor.

So, buy OTM -0.49 delta put while short ATM put with similar expiries, simultaneously buy OTM 0.5 delta call while simultaneously shorting an ATM call with similar expiries. This strategy is structured for a larger probability of earning a smaller but certain profit as USDCHF is perceived to have low volatility. Courtesy: Sentrix, Saxo & Commerzbank

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target