Already released industrial production data for the four largest Eurozone economies showed that output in the factory sector fell sharply in December. That points to a big slide in production for the region as a whole and we look for a monthly decline of 2.1%. Euro looks to be vulnerable again as the larger-than-previously-expected fall points to downside risks for Q4 GDP growth and we think that Friday’s update will see a downside revision to no change from the initial estimate of 0.1% GDP growth.

But one reason for the Yen’s appreciation when entering a global recession is that investors with speculative JPY short positions face increased volatility and buy back JPY to close their short positions; we note that there was a rapid reduction in speculative Yen shorts, as market recession expectations were re-aligned. From a fundamental point of view the market reaction is understandable.

Yesterday, the euro was little changed against the majors like dollar and yen soon after statements from ECB President Lagarde and Fed Chair Powell seemed to indicate that near-term interest rate moves in either the Eurozone or the US are unlikely. However, the major downtrend of EURJPY seems to be intact amid minor upswings. Hence, it wise to capitalize on momentary rallies for fresh short hedges ahead of flurry of data streaks in eurozone, such as, German ZEW Economic Sentiment, current a/c data, German, French & composite manufacturing/service PMIs.

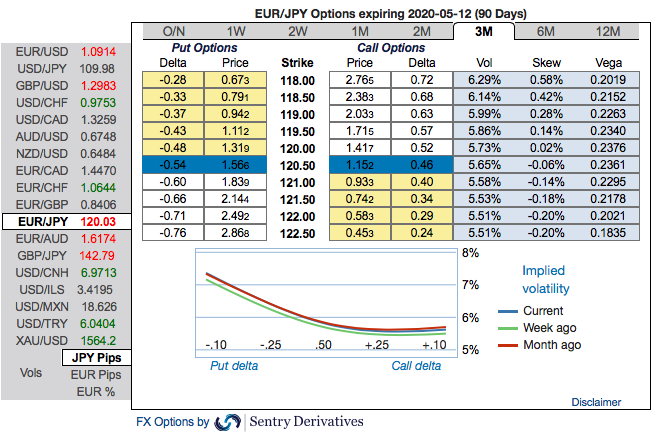

OTC outlook: Most importantly, the positively skewed EURJPY IVs of 3m tenors are also signifying the bearish risks in the underlying spot (refer 1st exhibit). The bids for OTM puts indicates that the hedgers expect the underlying spot FX to show further dips so that OTM instruments would expire in-the-money (bids up to 118 levels).

To substantiate the above indications, we could see fresh positive bids in the EURJPY bearish risk reversal (RR) set-up that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term (refer 2nd exhibit). Hence, we advocate below hedging strategy contemplating the above drivers and OTC indications.

Options Strategy: Contemplating above factors and the prevailing underlying sentiments, we’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging as well as trading grounds as the mild abrupt upswings were contemplated earlier.

Short hedge: Alternatively, ahead of above-stated data announcements that are scheduled for the next week, we advocated shorts in futures contracts of mid-month tenors with a view to arresting potential dips, since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for March month deliveries. Source: Sentry & Saxo

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different