As accurately anticipated in our earlier write up on option strategy of short put ladder, IVs have shrunk or steady, while underlying spot has been inching higher towards 74.462 levels.

Thereby, the shorts in advised strategy are on very much on track to fetch you the certain yields as the spot FX creeping up and theta of short tenors shows their effects of time decay.

Apparently, NZ April 2016 Merchandise Trade prints positive numbers that drives NZD's strength for the moment.

Balance: $292m (Westpac f/c: $80m, Market f/c: $117m)

Exports : $4,300m (Westpac: $4,380, Market: $4,420m)

Imports: $4,008m (Westpac: $4,320m, Market: $4,090m)

Annual balance: -$3,658m (previous: -$3,766m)

New Zealand's trade surplus rose to $292 mil in April, This saw New Zealand’s annual trade deficit pulling back to $3.7b, down from $3.8b in March.

Underlying April’s improvement in the trade balance was a 23% gain in export values over the month (adjusting for usual seasonal influences).

This was contributed to by strong increases in exports of dairy products and meat, but gains were widespread.

On the import side of the ledger, April saw a solid 12% rise - a result that was also likely affected by the timing of Easter. Excluding petrol, imports were up 11% over the month .

As a result of above economic numbers and appropriate functionality of the right derivatives instruments that were deployed in our strategy contemplating Option Greek computations, we continue to be firm with below strategy on hedging grounds.

Currency Option Strategy: NZD/JPY Short Put Ladder

Rationale: Unlimited downside still on cards in long run and limited upside profit potential in short run and higher IVs favor option holders in long run and writers in short run.

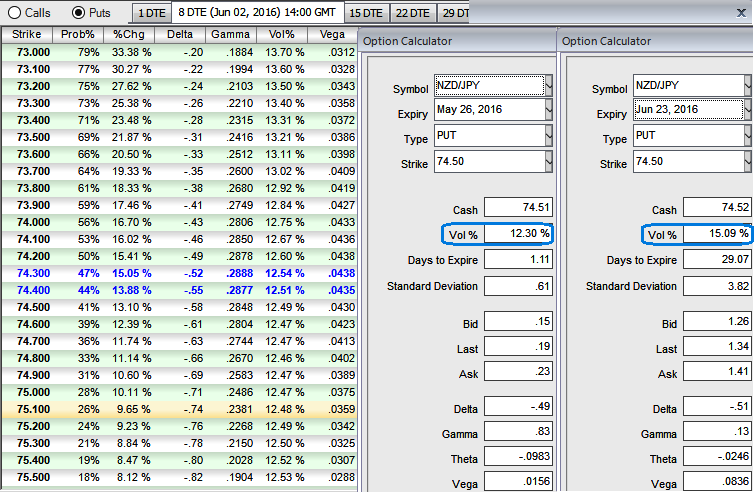

1W ATM IVs are trending higher at 12.30% and likely inch higher at 15.09% for 1m tenor which means the market thinks the price has potential for large movement in either direction, but you can observe the %change in premiums as the put contracts drifts into in the money (there exists the crux of derivative contracts).

Thus, go short in 1W (1%) ITM put option and simultaneously add longs on 1M ATM -0.49 delta put option and one more 2M (1%) OTM -0.35 delta put option.

Since the short put ladder is an unrestricted return with partial risk bearing strategy that is deployed because in addition to the puzzling uptrend in short term and downtrend in long-term, we think that the NZDJPY would also perceive significant volatility in the near term.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data