AUDNZD downward momentum persists despite recent bull swings, amid abrupt rallies the next major target 1.0326 (recent lows) and 1.0238 can also not be disregarded.

The pair in medium term perspectives: Higher to the 1.0650-1.0770 area, mainly for valuation reasons. The cross remains well below fair value estimates implied by interest rates, commodity prices, and risk sentiment.

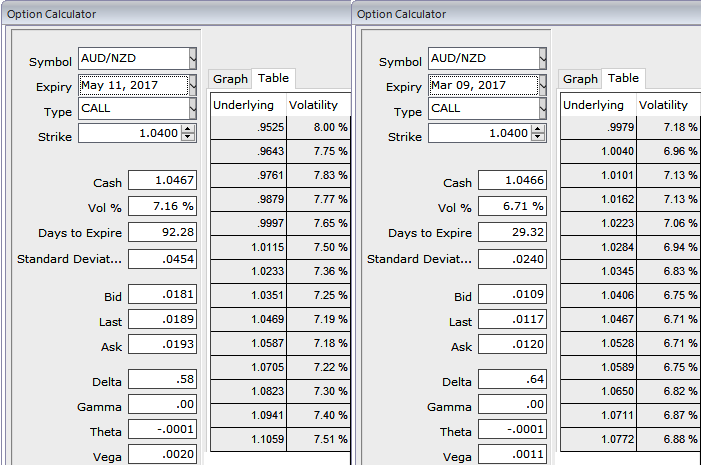

Please be noted that the implied volatility of at the money contracts of this APAC pair has been trading at a tad below 6.7% and 7.16% for 1m month 3m tenors respectively, while vega instruments of 3m tenor are signifying the hedgers’ interests in downside risks.

So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings in short run as the lower implied vols are conducive for option writers, accordingly, we had advised ITM shorts in put ratio back spreads and as the underlying spot FX has risen a bit, the writers could have pocketed the premiums that they have received from these shorts.

AUDNZD's lower IVs with theta’s interest on ITM put strikes could be interpreted as the option writer’s opportunity in short run.

The two main risks to our bearish AUD view are that (1) the currency is dragged higher in a more sustained re-rating of the global growth outlook and that (2) better global news and some signs of housing resilience see the RBA play for time. RBA has maintained status quo in last monetary policy to maintain the cash rates at 1.5% but we remain of the view that the RBA will ease a further 50bp going forward.

On the flip side, RBNZ should cause few ruffles in the market, with the policy stance (on-hold with a neutral bias) likely to be retained. That is because the positive impulse from dairy prices is roughly offset by the higher NZD TWI and higher funding costs. The RBNZ’s OCR projection should remain unchanged at 1.7%. But New Zealand remains highly exposed to a slowdown in Chinese demand, and the RBNZ won’t stay neutral in front of revived currency strength.

Weighing up all above aspects, we eye on loading up with fresh longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Go long in 2 lots of long in 3m ATM +0.49 delta put options, simultaneously, stay short 1m (0.25%) ITM put option, the position may gain if the underlying spot abruptly shows any mild gains. The strategy should be constructed at net debit with net delta at around -0.45.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic