EUR/GBP is attempting to break its 0.7780 support.

Given the non negligible risk of a less dovish Fed lifting the USD and more room for GBP appreciation against the EUR, odds favour shorts in EUR/GBP. The current dynamics open the door to further EUR/GBP downside targets in short run.

In contrast, if it manages to hold onto 0.7754, then there is no doubt in bulls resuming over the rallies back again, which could target 0.80 again.

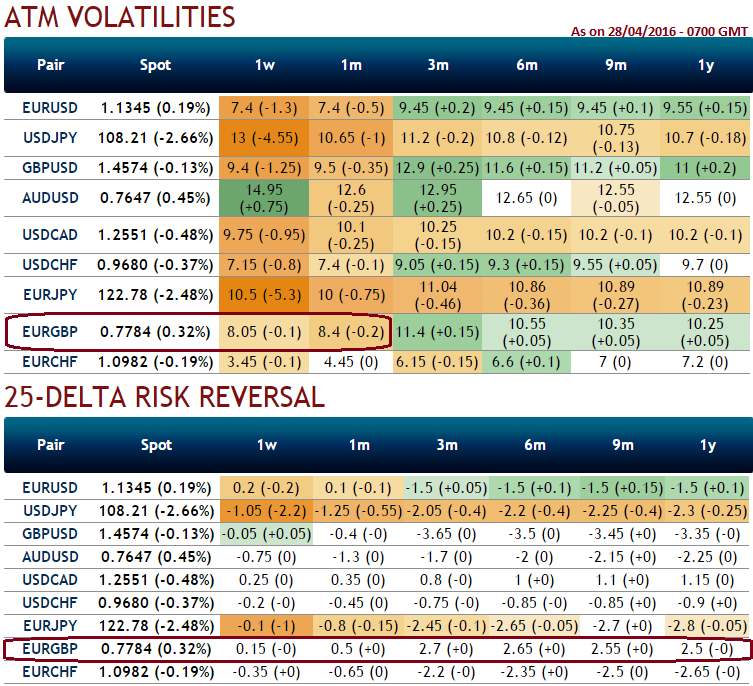

Well, whatever be the case, please be informed that the ATM IVs of this pair have reduced below 8.5% for 1w to 1m tenors, but risk reversals are still signalling upside risks in long run.

Given the remaining uncertainty and the conditional nature of the event, a tactical bearish trade should be implemented via options.

Volatility is likely to gradually normalise approaching the vote, accompanied by GBP topside momentum and some deflation of the risk premium.

The put spread ratio positions for a moderate downside move and will benefit from further normalisation in the volatility space.

The structure likely to generate leverage between 4x and 5x if the spot FX slumps close to the 0.75 strike at the 6w expiry.

We favour the 6w expiry to benefit from the current unwind, thus avoiding direct exposure to the outcome and enjoying better liquidity on the volatility market.