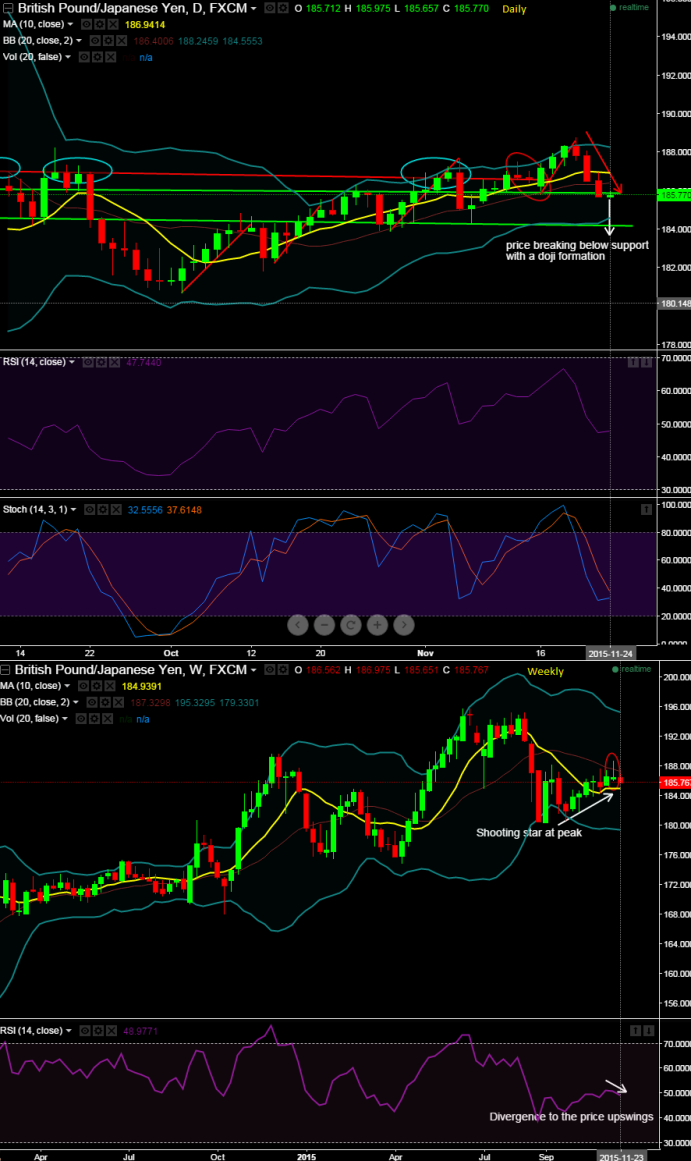

Shooting star at peak: It has been anticipated for some more corrections on GBPJPY upon the formation of "shooting star" pattern candle at peaks of uptrend at around 186.511 on weekly chart which has been unable to hold resistance at the same levels.

Gravestone doji breaking support: The pair has formed a candle resembling "Gravestone Doji at 185.794 levels urging for some declines on GBPJPY upon the formation of this bearish pattern on peaks of uptrend.

We now reckon that these bearish patterns have more downside potential and would reveal a medium term downtrend direction.

More substantiation: We are not isolating this signal, considering previous uptrend RSI oscillator is slightly diverging to those upswings which are deemed as trend reversal and heading towards 184.604 as strong support zone.

%D crossover is also spotted out on daily chart which indicates selling pressures are still on the table.

It is also important to emphasize that a hanging man candle pattern on monthly chart has been a warning of potential price change, not a signal, in and of itself, to go short. Overall pattern on the pair fixes it bearish view for a target of 184.604 and may even tumble up to 182.420 in medium terms.

FxWirePro: Shooting star signals GBP/JPY’s down streak to resume – retest of 184.604 most likely

Tuesday, November 24, 2015 7:11 AM UTC

Editor's Picks

- Market Data

Most Popular