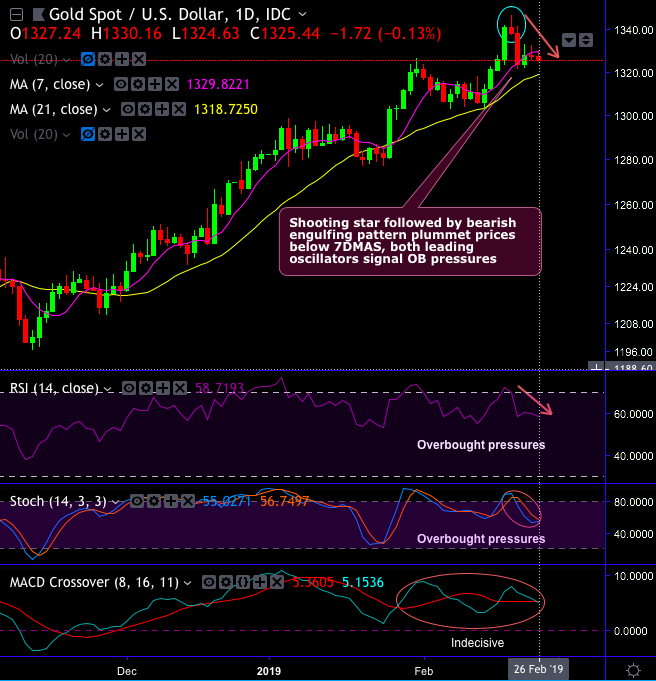

Technical glance: Gold (XAUUSD price) has continued to sense selling sentiments after shooting star and bearish engulfing formations at $1,338.10 and $1,323.40 levels respectively (on daily plotting). Consequently, bears have taken-off slumps below 7-DMAs.

For now, previous bullish sentiments seem to be exhausted as the momentum oscillators indicate overbought pressures.

More weakness likely as both momentum signal overbought pressures and trend oscillator (MACD) likely to show bearish crossover.

On a broader perspective, double top with consecutive shooting stars nudge price below EMAs on monthly plotting but can it be a triple top as there could be a potential doji formation?

On the contrary, hammer counters, momentum indicators substantiate bullish sentiment on this timeframe.

Bulls ensure consolidation phase as long as the current price remains above EMAs. Both RSI and stochastic curves, also converge upwards to the upswings, but faded strength is observed at 58 levels.

Trading tips: At spot reference: $1,325.27 level, on trading grounds, as Stochastic & RSI curves are indicating overbought pressures, one can trade this commodity with boundary options with upper strikes at 1,330.16 and lower strikes at 1,318.70 levels. The strategy is likely to fetch leveraged yields as long as the underlying price remains between above strikes on the expiration.

Currency Strength Index: FxWirePro's hourly EUR is at 71 (bullish), the hourly USD spot index is inching towards 3 levels (neutral) while articulating at 12:04 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex