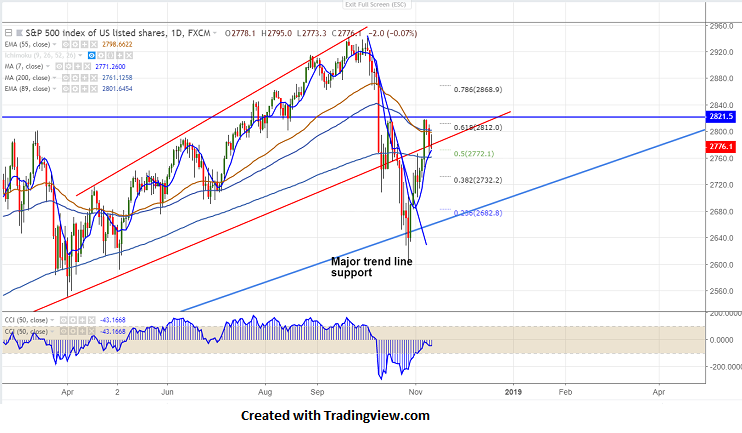

Short term trend Slightly bearish

Major resistance 2820

Chart pattern- Double top

S&P500 has declined almost more than 50 points after forming a double top around 2820.The index hits a low of 2763 and shown a minor jump . S&P500 has jumped more than 8% from low of 2603. The index has taken support near 200- day MA and any break below targets further weakness.It is currently trading at 2776 (0.06% lower).

The index’s near term resistance is around 2820 and any break above targets 2850/2900. Any break above 2821 confirms minor bullishness.

On the lower side, near term support is around 2761 (200- day MA) and any break below targets 2735/2700.

It is good to sell on rallies around 2795-2800 with SL around 2821 for the TP of 2845.