The Swiss National Bank (SNB) today kept policy rates unchanged at its quarterly meeting as expected by most market observers, i.e. the 3M Libor target and sight-deposit rate were kept at -0.75%.

This sent EUR/CHF lower as some probability of a rate cut was priced in ahead of the decision, albeit this had been markedly reduced after the ECB went for the 'light' easing menu last week.

Hedging Frameworks:

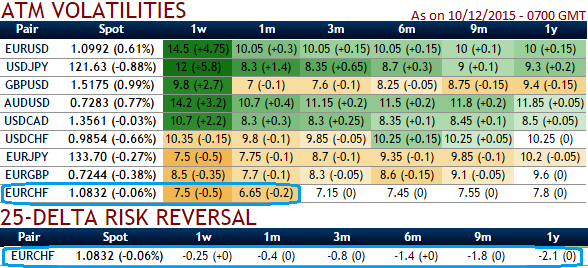

From the nutshell, 25-delta risk of reversals of EUR/CHF the most expensive pair to be hedged for downside risks after AUDUSD as it indicates puts have been over priced.

As it showed the highest negative values indicate puts are more expensive than calls (downside protection is relatively more expensive).

Since IVs of ATM contracts are sinking 1w to 1m timeframe among G10 space, no much dramatic movements would be expected in OTC but downside sentiments likely to persist.

With the above IV and risk reversal reasoning, we recommend arresting further downside risks of this pair by Put Ratio back-spread instead of strips which involves extra cost.

Strips employs an ATM call along with the puts double the size of call, but the above recommended strategy suits IVs and risk reversal scenarios.

Those who are so bearish in medium run but sideways or some abrupt spikes in short run ATM shorts with very shorter term expiries are recommended.

By doing so, you can not only participate in tiny rallies or sideways within 2-3 days time but also reduces the cost of hedging because of the initial receipt of premiums.

Whereas, strips cost extra by deploying an additional call option in this strategy and sharp jump in adverse scenario is needed for this strategy which seems unlikely in this pair.

So, purchase 2W 2 lots of At-The-Money -0.48 delta puts and sell 3D or 1w one lot of (1%) In-The-Money put option.

FxWirePro: SNB’s unchanged 3M Libor curbing EUR/CHF’s recent gains – prefer 2:1 spreads i/o option strips on reducing IVs

Thursday, December 10, 2015 1:21 PM UTC

Editor's Picks

- Market Data

Most Popular