The Swiss National Bank (SNB) abandoned its minimum exchange rate in January 2015 stating that it did not want to accept the further massive increase of its balance sheet total. Even though it has managed to stabilize EURCHF on the FX market with the help of cautious interventions risk events such as the Brexit referendum or the US Presidential elections illustrate clearly that from time to time the SNB still has to intervene quite heavily against the franc.

As a result, the SNB’s sight deposits and FX reserves have risen notably again. That means its balance sheet has continued to expand and its strategy has failed.

On the other hand, the SNB has reached the limits of its monetary policy scope as it has lowered interest rates into negative territory, which stand at -0.75%. A further rate cut to weaken the franc would only fuel cash holding. The SNB would initially stick to its monetary policy so that EURCHF would trade in a range around 1.08.

On the other hand, it will have to decide at some stage whether to prevent franc appreciation so as to maintain its inflation target or whether to consider the rise in FX reserves to constitute the bigger risk, which means stopping its interventions.

We think the inflation target will again draw the short straw which means that EURCHF would collapse at some stage. The timing, on the other hand, is difficult to predict.

OTC updates and option strategy:

If you glance through the IV nutshell, the implied volatilities of EURCHF ATM contracts across all expiries (especially 3m-6m) have been the least among G10 currency segment.

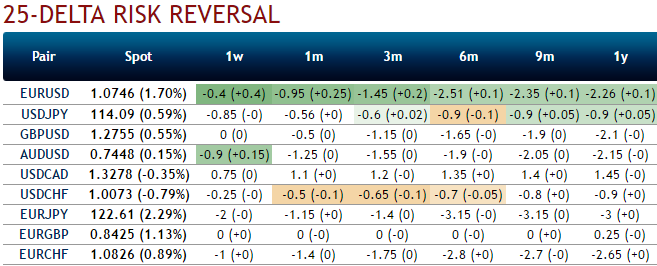

While the 25-delta risk of reversal of EURCHF has been indicating hedging sentiments for the downside risks, as a result it indicates puts have been relatively costlier.

Option-trade recommendations:

EURCHF’s range bound pattern is still persisting (Ranging between upper strikes 1.1110and lower strikes at around 1.0725 levels.

We could still foresee range bounded trend to persist in near future with upside potential in short term but the trend likely to remain very much within above stated range.

As a result, we recommend below option strategies using right options, thereby, one can benefit from certain returns as long as the underlying remains between the strikes chosen in the strategy on expiration.

Naked Strangle Shorting: Short 1m OTM put (1.5% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (1.5% strike referring upper cap) (we preferably choose short-term maturity).

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics