The post-policy SGD nominal effective exchange rate (NEER) is back into the lower half of its new neutral policy band.

This is consistent with the Monetary Authority of Singapore’s (MAS) expectation for core inflation to stay in the lower half of its official 0.5-1.5% forecast in 2016.

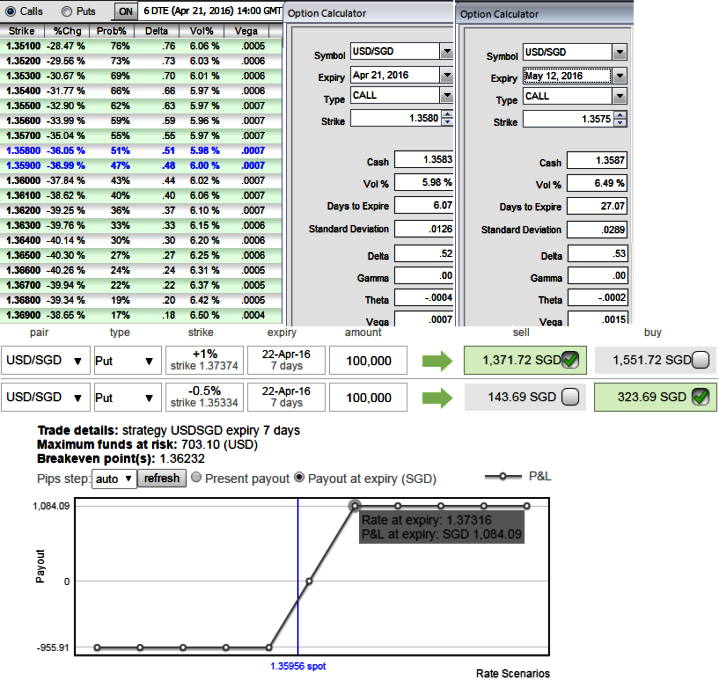

In USD/SGD terms, the trading range is approximately between 1.35 and 1.38 as of this morning.

Except for us, the central bank surprised markets when it ended yesterday, the modest and gradual appreciation stance that had been in place since Apr 2010.

FX Option Trading:

The current IVs of ATM contracts of USDSGD are at 5.98% but likely to remain below 6.5% in next 1 month’s time.

USDSGD’s major trend has been downtrend, but last two days’ bull swings could not sustain as it reaches trend 1.3657 levels.

Hence, it’s reckoned that any upswings in abrupt could potentially be utilized for the best entry levels for fresh shorts build ups for southward targets of 1.3525 or even upto 1.3420 levels with strict stop loss at 1.3635 levels.

Hence, considering implied volatility, OTC and underlying spot FX market sentiments we think short term downside risks are on the cards.

So, if you expect that USDSGD would tumble towards above specified targets over the next near future, then the upswings offered by bulls is the right times for shorts in puts with shallow ITM strikes and shorter expiries.

Well, then here comes the right strategy to tackle these type of swings, “bull put spread” at net credits, buy next month +1% Out of the money -0.5 delta put option. Simultaneously, short 1W (-1%) in the money put with positive theta.

Notice in this instance that the put we bought is out of the money and the put we sold is in the money with an anticipation of USDSGD could rise or remain unchanged, and there onwards any abrupt fall would be taken care by longs in OTM put and your active longs in spot FX would be protected.

Maximum profit: The initial credit received for this trade, less commission costs.

The maximum risk is the difference between the two strike prices, minus the credit you received.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX