RUB is often highlighted as a beneficiary of a potentially more amiable foreign policy stance towards Russia under Trump. Although clarity on this will not likely be forthcoming for months to come, RUB’s fundamental strengths should lead to an outperformance against TRY and ZAR.

Trump’s energy policy may result in downside pressure on oil prices eventually, and we think this poses a greater risk to RUB than any upside from a favorable foreign policy treatment. For now, though, there is sufficient uncertainty on this front, leaving us OW RUB.

With the deterioration in the local political situation and a less supportive environment from higher G3 yields, the outlook for the lira is worsening, in our view.

Going forward, the absence of local FX selling in the coming weeks could render USDTRY a lot more volatile than the market has grown accustomed to, in our view.

The central bank has expressed concerns over the currency, suggesting it would not cut rates further without FX stability, but we doubt this is enough to stabilize the lira.

While the CBRT could conduct FX sale auctions or release FX liquidity from its FX liabilities like it did last week, we think the impact of these measures would be modest, and so we do not expect the central bank to be particularly proactive with its toolkit to stabilize the lira in the interim.

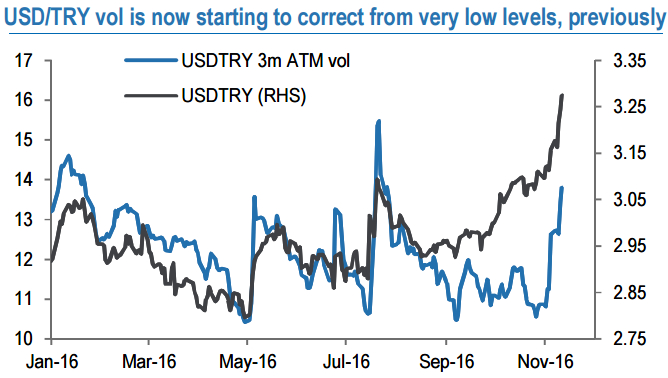

We find option exposure most attractive at present on account of the ATM vols impulsive responses, with implied volatility and skew trading near their lowest levels in a year when we entered our USDTRY call on 7th November (USDTRY vol has recently spiked higher following the global risk-off after the US election results, see above chart).

In outright trades, we maintain longs in USDTRY 1m15d debit call spreads, complementing above aspects and IV shift, the position reduces the hedging cost almost close to 50%.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges