We study CAD valuations by using a multi-disciplined approach that incorporates a combination of fundamental and technical analysis.

Technically, Loony has shown a strong signs of recovery as monthly charts pops up with a sharp shooting star formation with leading oscillators showing downward convergence. We reassess the valuation backdrop in the context of a sharp rise in USD/CAD to 1.4690 to begin the year, followed by an equally sharp pullback to 1.3639 in early February.

However, the present-day situation has USD/CAD trading to almost 12-year high as crude oil prices forge a new cycle low below /bbl in the aftermath of OPEC failing to agree to new quotas at their recent meeting in Tehran.

Despite crude's attempts of forming bottoms, we could still see some analysts pointing commodity direction at below $25 a barrel. This should maintain headwinds for the Canadian economy as we enter 2016, with GDP growth hampered by additional cuts to energy capital expenditures which, in turn, detract from business investment.

With many clients forced to grapple with this volatility, our efforts to conclude whether the risks to USD/CAD are symmetric or asymmetric in nature with respect to various valuation metrics. Misalignment on most measures is currently minimal and points to symmetrical price risks. Key support at 1.3629 serves as a pivot for the uptrend that has been in place for USD/CAD since last May.

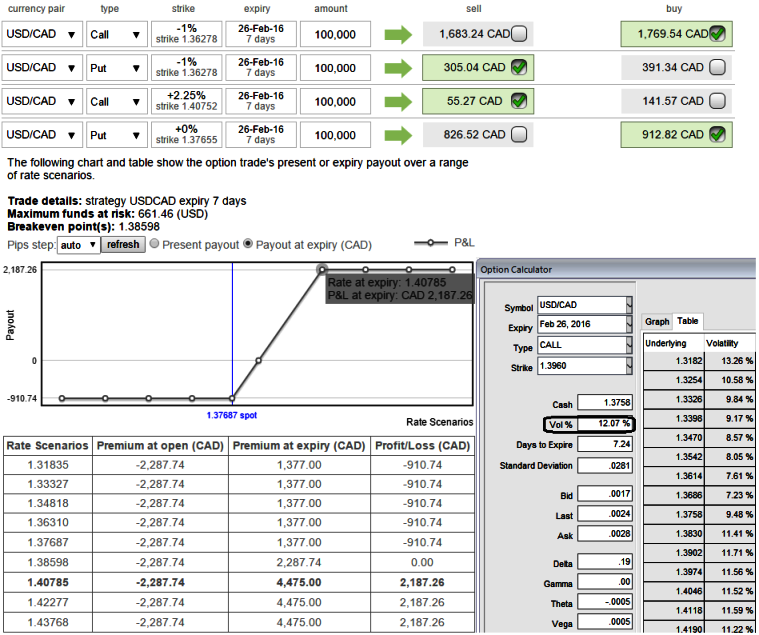

Hedging Framework: Jelly Roll Options Combinations

Spread ratio: (Sell 1: Buy 1: Buy 1: Sell 1)

Strategy Construction:

Go Short in 1W OTM strike call with positive theta

Go Long in ITM strike -0.71 delta put of the same expiry (1.4075/1.4075),

Simultaneously,

Go Long in 1M ITM strike 0.74 delta call

Go Short in OTM strike put of the same expiry with positive theta (1.3639/1.3649)

This overall position creates a synthetic near-term short position and long-term long position that work to capitalize upon the time differential between underlying futures prices.

Strike configuration:

Leg 1 strike = Leg 2 strike

Leg 3 strike = leg 4 strike

Leg 3 strike ≠ leg 1 strike

Leg Expiration:

Leg 1 expiration = leg 2 expiration

Leg 3 expiration = leg 4 expiration

Leg 1 expiration < leg 3 expiration

Please be noted that the expiries shown in the diagrams are for demonstration purpose only.

FxWirePro: Roll out with "Jelly rolls option combinations" for hedging USD/CAD's puzzling swings

Friday, February 19, 2016 9:47 AM UTC

Editor's Picks

- Market Data

Most Popular