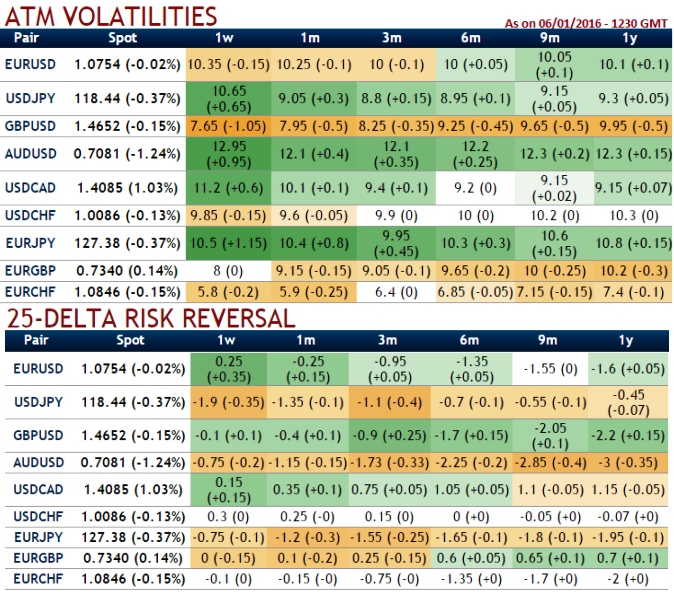

Please observe the IV factor for ATM contracts with 1w-1m expiries of Yen denominated currency crosses tops the risk reversal table for highest hedging activities eyeing downside risks.

These negative risk reversals is moving in tandem with rising implied volatilities which is quite reasonable as the volumes must also have been increased. It has been edging higher in case of EURJPY from 10.4% (1M) to 10.8% (1Y).

The gradual increase in negative delta risk reversal numbers signify how the OTC market arrangements are positioned to mitigate the potential downside risks in a long run while IVs are also gradually increasing would mean that EUR/JPY's downtrend in long run.

As we can very well understand the hedging activities of downside risks are mounting up, as a result ATM Put options seem costlier.

Volatility smiles most frequently tells that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

Hence, with the current spot FX is trading at 127.394, the recommendation is to add an extra-long on put with 1M expiry to any debit put spreads.

For fresh short build up positions, gazing at short term upswings short 1 lot of 2D (0.5%) ITM puts with positive theta values, simultaneously go long in 2 lots of 1M ATM -0.49 delta put and (use shorter expiries on short side as stated in the strategy).

Alternatively, the risk averse can even deploy option strips as well but idea is to capitalize on likely short term upswings for shorts on puts so as to enter the trade with least cost comparatively to option strips.

With these narrow strike differences, the profit potential is greater, so that the ratio needed is also lower to profit on underlying movement.

FxWirePro: Risk reversals signal “Yen taming both dollar and Euro”, EUR/JPY IVs back in action and so does PRBS

Thursday, January 7, 2016 7:45 AM UTC

Editor's Picks

- Market Data

Most Popular