The KRW has rallied significantly in the past three months; typically this would mean sharply lower implied vol and skew.

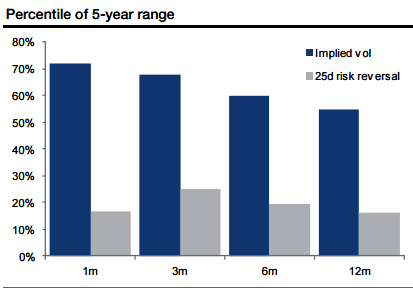

KRW implied vol (1m to 1y) is in the upper half of the 5-year range whereas 25d risk reversals are at the bottom end.

Risk reversals are a cheaper way to gain USDKRW upside exposure compared to owning USDKRW calls outright, especially with KRW strength looking a bit overextended.

Favour optionality to directional trades. We are inclined to position for a partial retracement of the down move through call spreads, as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

Call spreads are preferred to vanilla structures given elevated skew and favourable cost reduction.

A 3m 25d delta risk reversal (1158/1068 strikes) costs 0.20% of USD notional. Alternatively, the strikes for a zero cost risk reversal are 1159/1076 respectively. Losses are unlimited below the lower strike.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge