GBPAUD is an interesting pair to be closely watched and traded among G10 currency space ahead of monetary policy actions in both the continents (RBA and BOE).

BoE on Thursday will be the key, with the inflation report seeing expected effects from Brexit on the real economy. Markets awaits further stimulus, pricing a 90% chance for 25bp cut in Bank rate and some looking for more QE.

Growth will slow due to increased uncertainty in Brexit scenario and formal procedures, negative trade effects and tighter financial conditions. - BoE will respond by an interest rate cut to -0.25%. The policy will remain at this low level to 2019. - The GBP may recover when uncertainty abates and fears of a severe negative economic outcome is reduced.

The foreign traders dealing with AUD crosses would have more IVs though ahead of RBA cash rates make bearish sentiments in 1W OTC contracts but we reckon that BOE decision seems to be more imminent as sterling would have additional risks associated with GBPAUD.

However, any abrupt upswings could be viewed as a better entry point to stay short in this pair and long term range lows have led to a deeper southward targets which still appears incomplete ahead of RBA’s rate cut expectations.

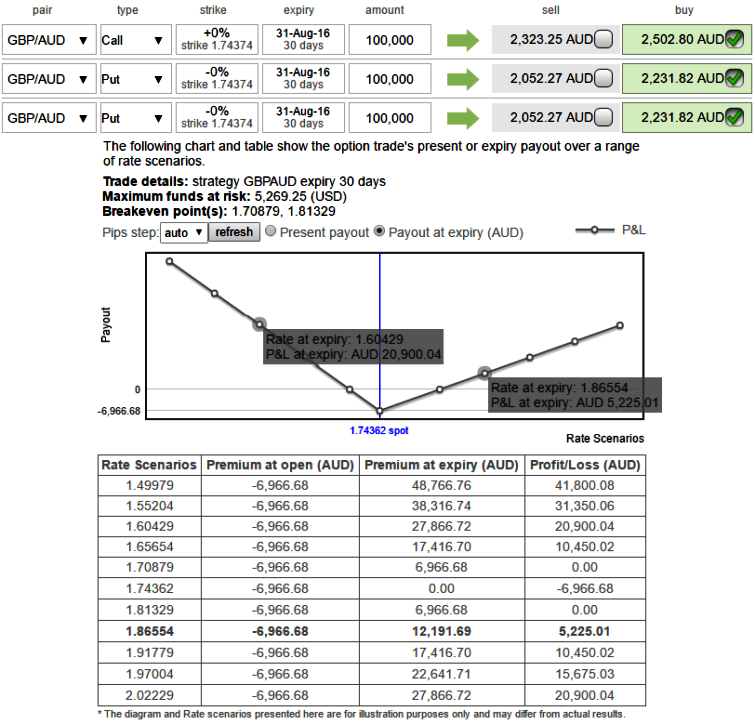

Hedging Strategy:

Go long in 2 lots of 1m ATM -0.49 delta puts, while long in +0.51 delta put of the same expiry, See that payoff function the strategy likely to derive positive cashflows regardless of swings but more potential from 2 puts are more than 1 call.

Risk is Limited to the price paid to buy the options.

Reward is Unlimited till the expiry of the option.

Please note that the trader can still make money even if he was wrong – but the stock has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

When to use this strategy: Suppose any negative surprising news from BOE revolve GBPAUD and you want to take your odds on downside risks – you can trade a Strip. Please be noted that technically it is not required that you buy only ATM options. You can probably buy options from any strike but both calls and puts should be of the same strike.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook