The Reserve Bank of India’s (RBI) governor Raguram Rajan announces 25bps rate cut on Tuesday which has been in line with street's expectations, but a bigger surprise was the host of liquidity-supportive measures.

The first bi-monthly monetary policy review meeting of the RBI for the year 2016-2017 is not just about interest rate cut or addressing concerns over liquidity, but assessing struggling global economy.

The policy eases the liquidity constraints in the banking system, giving hopes for the industry and consumers that interest rates in the economy will fall faster than earlier.

These concurrent moves will complement the easy policy stance with an efficient and smoother transmission process.

The guidance retained its data-dependent nature, subject to monsoon progress, direction of headline/ core CPI inflation and effectiveness of the transmission process.

The inflation targets were benign but outlook was balanced, with headline targets set at 5.1% for 1Q17 and to ease towards 4.2% in 1Q18.

Upside risks after RBI's policy are as follows:

Uncertainty over monsoon progress

Pay commission impact

Falling reservoir levels and the recent upturn in global oil prices.

Rupee depreciation

The pair (USDINR) bounced back from initial loses and was trading up by 13 paise at 66.58 levels at noon trade on bouts of dollar demand from banks and importers, thereby, rupee lost about 0.80% from last two days to show a spike from lows of 66.05 upto the current 66.58 levels.

The rupee resumed marginally higher by 4 paise at 66.42 as against yesterday's level of 66.46 per dollar at the Interbank Foreign Exchange market.

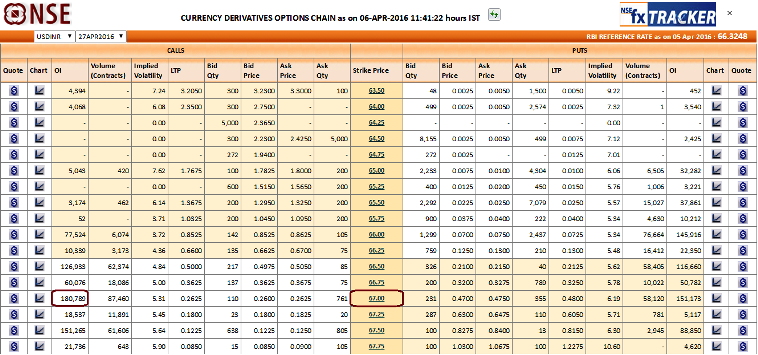

As you can make out from the above table, that the highest open interest seen in OTM strikes calls (67 levels) on NSE (National Stock Exchange).

Hence, we advise for trading purpose, avoid options with lower volumes and lower open interest.