Is this the right time for even a partial rollback of our coronavirus lockdowns and resume our respective businesses? The prevailing pandemic doesn’t seem to allow that, the total reported death cases exceeds 1.4 million due to the deadly contagious coronavirus, almost all markets have halted with a trauma.

But, China’s Wuhan megalopolis, the outbreak’s first epicentre is finally relaxing its rules after a lockdown that lasted more than two months. As of today, outbound travel is allowed again, at least for those who can show a green QR code on their phone screen that denotes good health.

China's FX reserves declined by USD46bn in March, the biggest drop since December 2016. However, the authorities explained that this is largely due to the valuation effects as stock market crashed in March and dollar strengthened (which would reduce the dollar value of non-dollar reserves). Recent data provided by Chinese foreign exchange regulators suggest that corporates and individuals have turned to net selling dollar positions (i.e. long CNY) in the first two months of 2020.

Nevertheless, it remains questionable whether this trend could sustain. In the FX market, CNY simply ignored the seemingly negative headline reserve data, and rallied against the overall risk-on sentiment, with USDCNY below 7.05 mark.

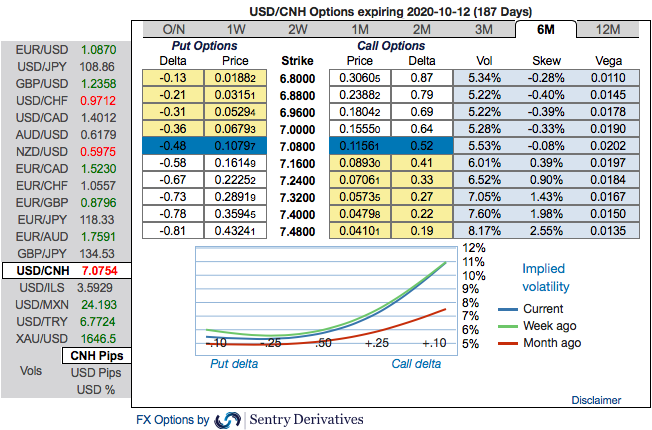

Please be informed that the positively skewed USDCNH IVs of 6m tenors still indicate the upside risks, they are still bids for OTM call strikes up to 7.48 levels.

Hence, at this juncture, we uphold our shorts in CNH on hedging grounds via 6-month (7.00/7.40) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CNH recommendations. Courtesy: Sentry & Commerzbank

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays