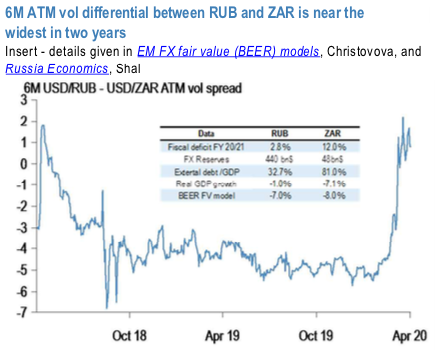

RUB vs ZAR is one pocket of EM vega where we feel comfortable considering an RV. Namely, on the back of the recent oil collapse 6M ATM vol differential between RUB and ZAR shot up to near the widest in two years.

We’ve already noted that one week after Moody’s rating downgrade the rating agency Fitch has further downgraded its sovereign rating for South Africa, now taking it to two steps below investment grade, and has also given it a negative rating outlook As a result USD-ZAR reached a new high at 19.30. However, the rand recovered intraday on a wave of risk-on as a result of positive news regarding the corona pandemic from some regions.

The oil price freshly gained yesterday but struggling again today after brief rallies, with brent reaching almost the $20/bbl mark in the recent past amidst fresh risk-off movements which drove most EM currencies weaker against the dollar. The broad-based weakening of emerging market currencies in recent weeks may sometimes make it difficult to observe any fundamental patterns.

With the potential for a resolution on the OPEC / Russia production side RUB vega could come under pressure. Also, the vol backdrop is a stark contrast to the recent spot dynamics. One-month lookback indicates comparable moves in the spot market with ZAR losing about 19% of its value and RUB 17%, while during the same period the 6M ATM spread has gone from -4/5 handle to +1vol now.

Also, our analysts see the fiscal and economic position of Russia is to be much stronger than that of South Africa (refer above chart).

Consider fading the RUB – ZAR vol dislocation via limited downside structures: Long 6M USDZAR 25% mid TV at-expiry digital call and finance it by selling 6M USDRUB 25% mid TV at expiry digital call at net cost of 6% USD indicative. Courtesy: JPM

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis