The European recovery theme has become increasingly mainstream in recent weeks as continued Euro-area growth out-performance intersects with moderating political risks. Last week, we opened an outright long EUR/USD position in covered call format to go with a suite of other bullish Europe expressions (long SEK, CHF). We list below a few other option-based expressions of Euro strength assuming that French elections deliver a market-friendly outcome:

EUR call flies: Our spot targets for EURUSD if Le Pen loses are relatively benign –in the range of 2-3 cents from current levels since neither positioning metrics nor deviations from high-frequency fair value models suggest that there is much political risk premium in the currency that requires de-pricing (When and if Le Pen loses).

In addition, EUR options still pack in a reasonable amount of election risk premium despite their recent softening, which will almost certainly disappear after the passage of the event –a key reason to recommend covered calls in lieu of outright cash longs in the FX Markets Weekly macro portfolio.

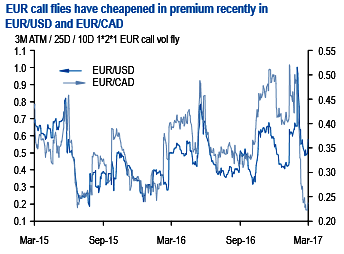

EUR call/USD put flies can be rationalized on similar grounds: there isn’t much skew advantage to selling OTM EUR calls although they have normalized a tad as option-buying interest has picked up recently, but their short vega exposure helps defray part of the negative interest rate carry cost and call flies, on the whole, have become more reasonably priced of late (refer above chart).

Our preference is for RKI flies (RKI on the middle leg) where the trade-off of a few more bps in option premium for materially extended participation in the spot uptrend is an acceptable one. 2M 1.10 –1.12 with 1.14 RKI –1.14 EUR call/USD put flies cost - 30bp EUR (spot ref. 1.0612, max payout ratio 5.7 times if RKI triggered, 11.3 times if not).

Along similar lines, we also like EUR call/CAD put flies. The macro view on CAD is negative on a mix of BoC dovishness, sensitivity to NAFTA renegotiation talk which is likely to re-enter headlines over the next few weeks, and the potential for further near-term slippage in oil prices.

Option pricing heavily favors EUR call/CAD put fly ownership, which are near 3-yr lows in premium (refer above chart). 2M 1.46 – 1.49 with 1.52 RKI –1.52 EUR call/CAD put flies indicatively cost at 35 bp EUR (spot ref. 1.4137, max payout ratio 5.8 times if RKI triggered, 11.4 times if not).

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand