- New Zealand economy is looking solid and yesterday terms of trade saw a 4.4% rise, which is one of many “fundamentals”.

- RBNZ’s meeting next week (which will be accompanied by a full Monetary Policy Statement) is a major event risk.

- The market prices only slightly more than a 20% chance of a cut at the meeting.

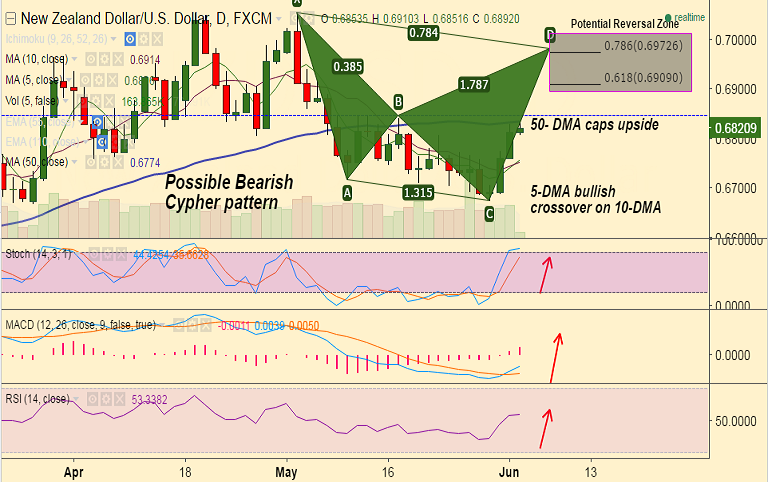

- On the technical side, we see a possible 'Bearish Cypher' pattern on NZD/USD daily charts.

- Potential Reversal Zone: 0.6909 - 0.6973

- For now uptrend intact. Pair is currently struggling at 50-DMA (0.6834), break above to see further upside.

- Our previous call (http://www.econotimes.com/FxWirePro-NZD-USD-edges-lower-from-session-highs-at-06813-momentum-higher-good-to-buy-dips-215551) has achieved target-1.

- Bullish invalidation below 21-DMA at 0.6772.

Recommend booking partial profits, raise stops to 0.6770, hold for upside.