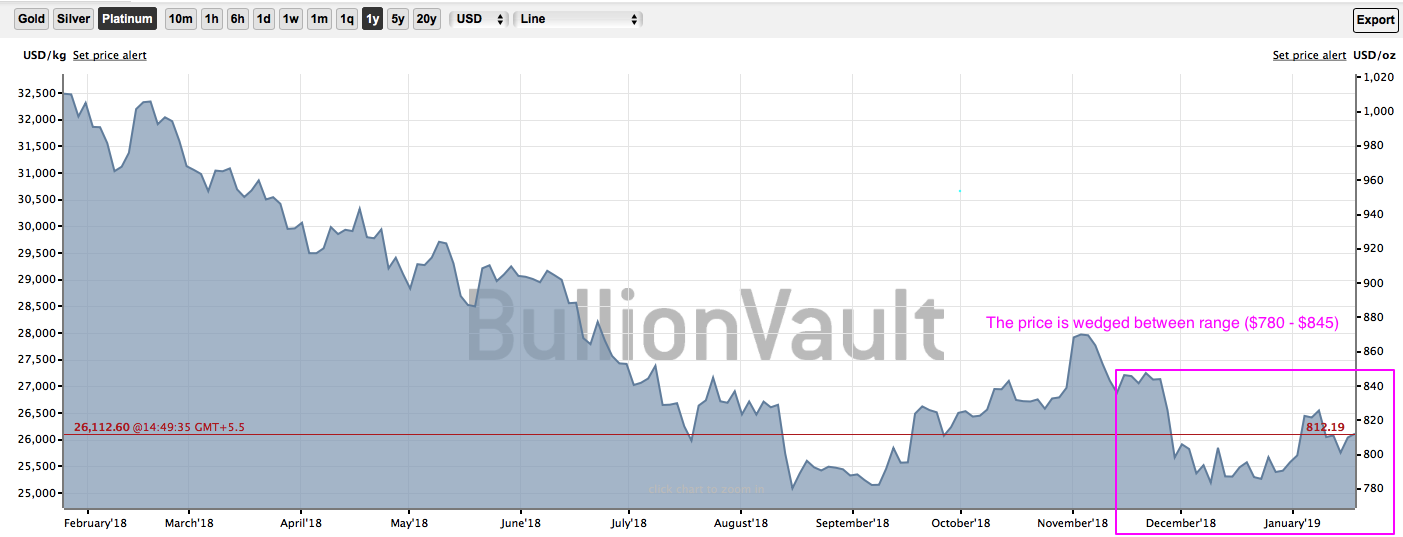

Of late, the platinum price has been oscillating between $780 - $845 range (refer 1stchart). Outside of a one-day 3% up move on January 4 (refer 2ndchart), platinum prices have been extremely stagnant of late and range- bound recently as the metal has largely failed to appreciate in sympathy with gold over the last couple of months.

This hesitancy in platinum is most clearly illustrated by the breakdown in the daily platinum vs gold correlation, which dropped below its recent range in late December and has recently fallen to below +0.4, its lowest level since 2011 (refer 3rdchart).

The divergence between the two metals now means that the discount of platinum relative to gold is flirting with $500/oz (refer 4thchart).

But on the flip side, as explained in our previous post on PGM segment, South African platinum supply has finally begun to slowly rationalize. Yet, just as necessary cuts will likely gain momentum in 2021, we forecast the trend will reverse as new mines ramp up.

As a result, the platinum picks up the torch from here, in our opinion, rallying throughout 2H’19 as the macro picture becomes murkier.

The prices have also trended higher in the last quarter, even slightly outperforming gold, meaning that at current prices around $845/oz, platinum’s discount to gold has dropped back below $400/oz.

The reversal in price trend for both metals is clearly reflected in positioning; however, given the amount of short covering in platinum over the last two months, it’s actually a little surprising we haven’t seen more outperformance.

Outside of futures markets, ETF holdings have largely continued their recent trends uninterrupted with platinum holdings still stagnating around 2.5 million ounces while palladium ETF ounces continue to draw, giving the physical markets some much-desired additional ounces. Courtesy: BullionVault, Bloomberg & JPM

Currency Strength Index: FxWirePro's hourly EUR spot index was at 42 (bullish), USD is at 101 (bullish), at press time 09:42 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation