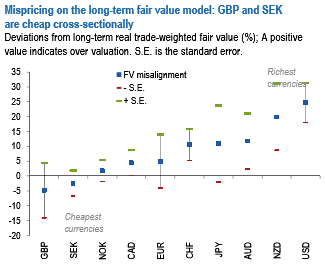

Despite being an underperformer in G10 in the past month, EUR still screens near fair value on this framework, indicating that little political risk is priced in ahead of the French elections. This is also consistent with the conclusion from our cyclical models which indicate that EURUSD is near fair value adjusted for US-Bund rate differentials and with our macro view that EUR has the potential to weaken in the run-up to the French elections. The richness in EUR is comparable to that in CHF on this framework, a gap we think should widen in favor of CHF.

GBP continues to be the cheapest G10 currency on this framework cross-sectionally, but still, has room to weaken further relative to its history. GBP remains the cheapest currency with G10 when ranked cross-sectionally on this framework (refer above chart).

However, the currency has room to weaken further relative to fair value since historically (in 2008), it traded as much as 20% cheap to fair value. Our macro view remains structurally bearish on GBP and we do not believe that a further 5-10% weakening eventually is not unreasonable given the dependence of UK on foreign capital.

In outright trades, we hold:

Long USDPLN 23-Feb-17 and EURPLN 1x1 debit call spread (ATM, 4.60), at spot ref: 4.0757.

Long 23-Feb-17 EURILS 1x1.5 put spread (4.05, 3.90), at spot ref: 3.9518.

Short 27-Nov-17 EURCZK forward.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data