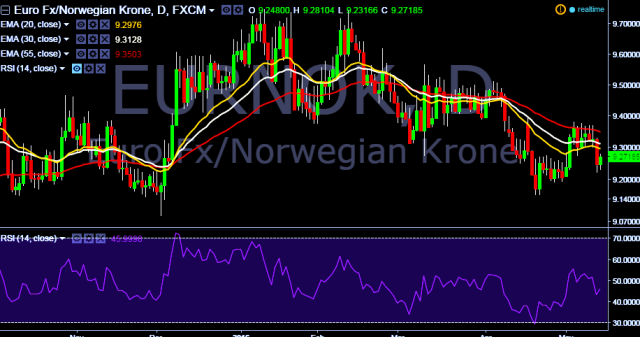

- EUR/NOK is currently trading at 9.2671 levels.

- It made intraday high at 9.2713 and low at 9.2316 levels.

- Yesterday Norway Central bank kept policy rate unchanged at 0.50 percent.

- In addition, Norway's Q1 GDP +1.0 pct q/q (consensus forecast +0.1 pct).

- Intraday bias remains neutral for the moment.

- A daily close below key support 9.2447 level will drag the parity towards 9.16 marks.

- Initial resistance levels are seen at 9.3759, 9.3862 and 9.3896 levels.

- On the other side, key support levels are seen at 9.2353, 9.1686 and 9.1615 marks.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiate a long or short trade. We will continue to remain on sidelines for the time being.