After two days of crazily spiked EUR/NOK bulls, now seem to have given up the momentum from the last couple of trading sessions.

Bearish momentum for the pair is back. We begin the year at a historical lows of (the EUR/NOK reached 9.70), the Norwegian krone considerably resurged in 1st half of 2016 so far and the upturn should continue in the coming months is a close and dubious call.

The euro is projected to remain on a slow downward trend, but tough to guess the collapses especially against this Scandinavian currency, reflecting the return of the gradual divergence in the monetary policies of the ECB and the Fed.

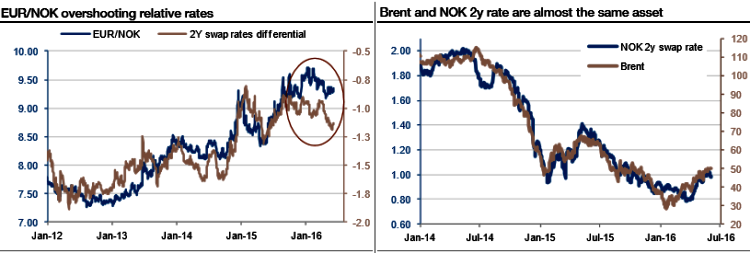

Overshooting relative rates. The EUR/NOK remains essentially driven by short-term interest rate differentials, where the FX/rates divergences tend to disappear given the strength of the relationship.

The spread in 2y swap rates, however, plunged deeper into negative territory, at a faster pace than the decline in the exchange rate. European short rates are at a standstill but Norwegian rates picked up along with the rebound in oil prices, which is the key resource of the local economy.

Nevertheless, NOK has been catching up with consolidating crude oil price patterns. Norwegian interest rates are very closely correlated to oil prices, so the FX/rates link implicitly embeds the sensitivity to the commodity complex as a core driver.

Not only is the NOK lagging the oil bounce and likely to catch up, but we anticipate he prices to stay firm given the contraction of US production and robust global demand.

Hence, only a material recovery in oil prices from here onwards is likely to stop those cutting rates to new historic lows.

While this risk overhangs, we maintain a negative stance on the FX pair, with EUR/NOK expected to retest the recent lows around 9.15-17 by this quarter end (currently we aren't far away from this target).

Well, for sceptic bulls can add their long FX portfolio with OTM call writings.

The main objective of writing calls is to collect the premiums when the options expire worthless.

One would write an out-of-the-money call and if the underlying spot FX price stays flat or drops, one would pocket the premiums and repeat the process as long as the perceived market condition remains unchanged.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields