As widely anticipated, the NBP kept the main policy rate at 1.50%, while delivering a neutrally toned press statement followed by a rather bullish press conference by Governor Glapinski.

This MPC remains to a large extent focused on growth developments above all, while the bout of negative inflation continues to be seen as a temporary anomaly with no undesired effects at the consumer or investment decision levels.

In that context, it seems that policy easing is not an option being considered. The Q&A was the most interesting bit of the rate-setting decision, in our view, with the Governor repeating the past meeting’s hawkish rhetoric but now specifying that a hiking cycle would be necessary from early 2018 (instead of late 2017).

We expect that GDP growth would stay at 3.0% during 2016 and 2017, which although below the NBP’s projections is within the MPC comfort zone, and hence, insufficient for the board to consider rate cuts again, more so given the hawkish bias displayed by Governor Glapinski.

We expect the NBP will stay on hold throughout 2017.

FX Option Strategy:

Although the EURPLN showing strength, the intermediate trend seems to be little weaker and IVs of this pair are on the lower side which is a good sign for option writers capitalizing on momentary upswing sentiments.

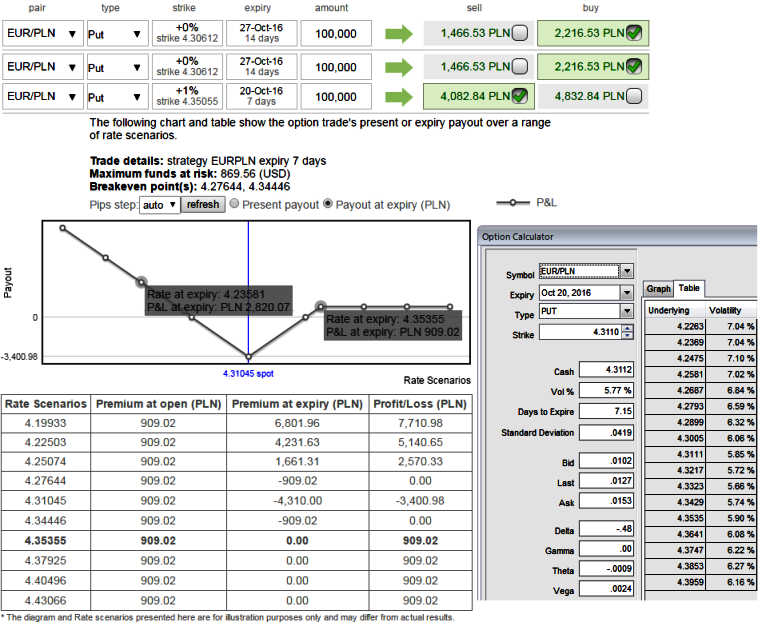

To factor in the weakness in this pair, we recommend capitalizing more on bearish signals and the IV factor in the long term by employing ATM longs to construct back spreads choosing narrowed expiries that likely to fetch positive cash flows as shown in the diagram.

Please be sure that a large move in the underlying should be allocated with longer tenor (targets set at 4.2507 levels) and can be withstood without losing any money at break even levels of 4.2764 and 4.3444 levels. This should be of greater concern than doing the spread for reducing debit.

So, here goes the strategy this way, At spot ref: 4.3060, go long in 2 lots 2w ATM -0.50 delta puts, and simultaneously short 1W (1%) ITM shorts, the spread is to be executed in the ratio of 2:1with net delta at around -0.70.

The delta of the strategy is at 70%, which means there is more likelihood of long options expiring ITM on expiration (have a look on sensitivity table), these instruments are the major contributors in the strategy as you can refer %change in premiums and their probabilities to hit the OTM strikes.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand