The Aussie has seesawed in recent weeks, absorbing mixed signals from US interest rate expectations, commodity prices, and US-China trade developments. Recent (closing) lows since early 2009 followed fresh US tariffs on China and a warier tone from the Fed. But rates markets are likely to remain aggressively priced for further easing at both the Fed and RBA, so enough downside is probably priced in for AUD in terms of yield spreads.

Meanwhile, resilient commodity prices are driving record Australia trade surpluses and large resource company dividend payments which should lend some support to AUD late Aug/ early Sep. So while fresh decade lows for AUDUSD would not surprise near-term, so retain our 0.68 end-Sep forecasts. We have made no changes to our year-end AUDUSD projections and still foresee AUD at USD0.66 and below levels by Dec-19 on the back of a weaker growth backdrop for the domestic economy and our expectation of further easing from the RBA, OTC bids are also substantiating the same.

However, a near term pause from the RBA, dovish rhetoric from the Fed, sequential improvements in China activity data in June and hints of a near term stabilization in global output may give AUD some near term support.

Contemplating the above factors, we will now quickly run you through OTC outlook of AUDUSD, before proceeding further into the options strategic framework.

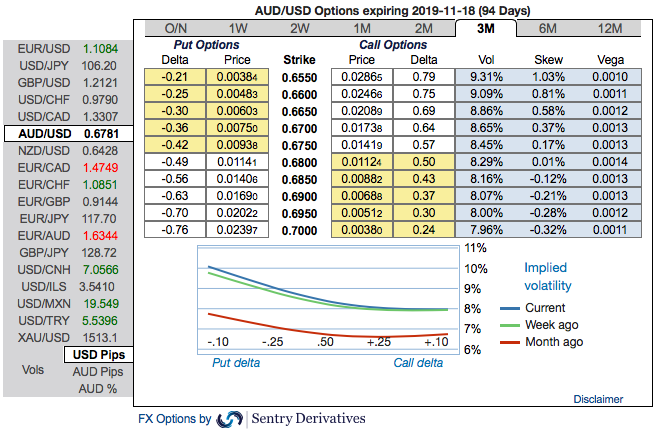

Please be noted that the positively skewed IVs of 3m tenors still signify the hedgers’ interests to bid OTM put strikes up to 0.6550 level which is still in line with the above bearish trend (refer 1st nutshell).

Please also be noted that the minor positive shift in risk reversals (RRs) of the shorter tenors and bearish RRs of the longer tenors that are also in sync with the bearish scenarios refer 2nd (RR) nutshell.

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks have been clear.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution of options strategy: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

The rationale: Bidding above 3m IV skews, we have advocated delta long puts for the long term on hedging grounds, comprising of more number of ITM long instruments and theta shorts with narrowed tenors for 1m lower IVs to optimize the strategy.

Bearish outlook with rising volatility good for the option holder.

While put writers would be on the upper hand on theta shorts in OTM put options that would go worthless on lower IVs as the underlying spot FX keeps rising. Thereby, the premiums received from this leg would be sure profit.

We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix, Westpac and Saxobank

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close