We could foresee that the recent sharp rally in the precious metal's price is a selling opportunity. The gold price seems to be discounting no further Fed rate hikes this year and very little tightening next year.

The precious metal has been bouncing consecutively especially with a sentiment of "safe haven" among all asset classes from last couple of weeks but as stated in our earlier apart from that we see no fundamental reasons to substantiate these price bounces.

China's imports of gold from Hong Kong slumped to the smallest since 2011 in January after surging to the highest level in more than two years in December, as global prices climbed the most in a year.

Net purchases by the world's largest consumer fell to 17.6 metric tons from 111.3 tons in December and 71.6 tons in the same month last year, according to data from the Hong Kong Census and Statistics Department compiled by Bloomberg.

The gold on the Comex division of the NYME for April delivery has stapled by $4.50, to trade at $1,239 a troy ounce by 10:00GMT. Prices of the yellow metal hit a one-year high of $1,263.90 just a few days ago.

Our economists expect the US economy to withstand the slowdown in emerging markets, and this should over time cause the market to price in a moderate pace of Fed tightening.

Also, the recent gold price rally looks unsustainable given the strength of the US dollar, keeping in mind their broad inverse relationship. Finally, the recent very pronounced downtrend in the BCOM index suggests that the gold price rally is unsustainable.

Although, the gold futures rose in European trade on Tuesday, with prices re-approaching the highest level in a year amid mounting expectations for further stimulus measures from central banks in Asia and Europe may carry huge uncertainty in its trading.

Hence, we recommend bullion traders to stay hedged using below commodity option strategy.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

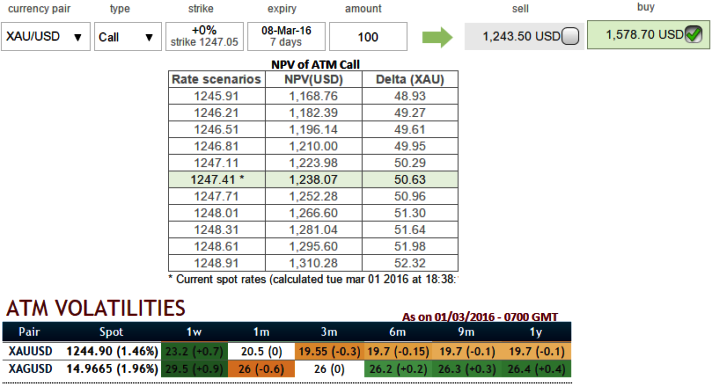

Rationale: ATM premiums are trading 27% more than NPV, while implied volatility of these ATM 1W contracts are at 23.2%, hence there exists a considerable disparity between premiums and vols that keeps us eye on shorting such expensive calls. As a result, we capitalize on such beneficial instruments and deploy in our strategy.

How to execute:

Go long in XAU/USD 3M At the money delta put, Go long 6M at the money delta call and simultaneously, Short 3M (1.5%) out of the money call with positive theta.

FxWirePro: No fundamental rationale for yellow metal to swing up - hedge via 3W straddle vs call on disparity between premiums and IVs

Tuesday, March 1, 2016 1:20 PM UTC

Editor's Picks

- Market Data

Most Popular