NZD continues to trade well - in trade-weighted terms, it is at a 6m high. The RBNZ may have cut rates early in December but it also hinted the easing cycle may be over and that turned what ordinarily would be a currency negative event (a 25bps cut that was only 60% priced in ahead of the meeting) into something currency-positive.

The Dec 9 statement came with more jawboning on NZD ("The rise in the exchange rate is unhelpful and further depreciation would be appropriate in order to support sustainable growth") but in the same statement the Bank says it expects to achieve its policy target "at current interest rate settings", so there is no credible rate cut threat to drive NZD lower.

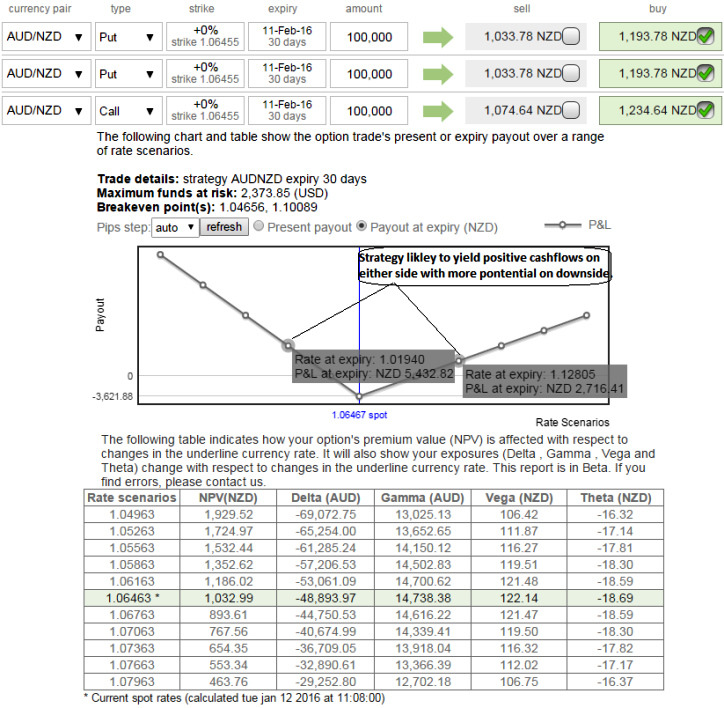

Hedge using currency option strategy:

The options strips are deployed anticipating more downside potential in AUDNZD, now have a look at the diagram fro prevailing prices of ATM puts and they are moving in line with healthy delta.

What makes ATM instrument more productive in our strategy: the delta of this instrument is here at its fastest rate and gets faster as your position come closer to the expiration date. As a result, time decay may have a relevant impact on ATM options.

Go long in 2W At-The-Money 0.50 delta call and simultaneously hold 2 lots of 1M At-The-Money -0.49 delta put options. Huge profits achievable with the strip strategy when AUDNZD exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

From the diagram we can understand how the profitability can be maximized for every shift towards downside and this is not the same on upside.

Please be informed that the trader can still make money even if his anticipation goes wrong - but the underlying pair has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

FxWirePro: NZD continues to gain in H1 upon RBNZ’s hints – What makes ATM delta puts more productive in AUD/NZD diagonal strips

Tuesday, January 12, 2016 5:46 AM UTC

Editor's Picks

- Market Data

Most Popular