The implied volatility of -0.49 delta ATM put with 1w expiry is 9.35% and

The implied volatility of 0.51 delta ATM call with 1w expiry is at 10.51%.

It measures the skewness of the volatility smile (OTC is gauging upward sentiments in underlying market), the extra volatility which is added to the 0.5 delta put volatility compared to a call volatility which has the same absolute delta.

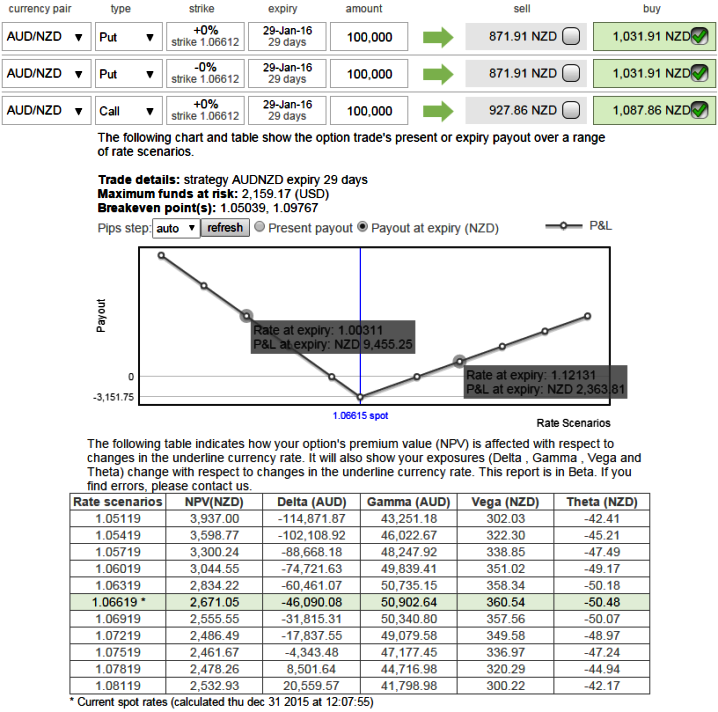

Currency Option Strategy:

The options strips with diagonal expiries were deployed anticipating more downside potential in medium to long term and some spikes in short term, now have a look at the diagram for prevailing prices of ATM puts and they are moving in line with healthy delta.

We've been firm to hold on this strategy both on hedging and speculative grounds. The potential target on upside is about 50-100 pips where 100-120 pips on downside.

The rationale is that any potential downswings should be optimally utilized, so to participate in that downtrend, weights in the portfolio should be doubled with ATM puts.

What makes ATM instrument more productive in our strategy: the delta of this instrument is here at its fastest rate and gets faster as your position come closer to the expiration date. As a result, time decay may have a relevant impact on ATM options.

Hold 15D At-The-Money 0.51 delta call and simultaneously hold 2 lot of 1M At-The-Money -0.49 delta put options. Maturities shown in the diagram are meant for demonstration purpose only, keep shorter expiries on calls and lengthier expiries on puts.

Huge profits achievable with the strip strategy when AUDNZD exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

Please be informed that the trader can still make money even if his anticipation goes wrong - but the underlying pair has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

FxWirePro: Long AUD/NZD in short term, long term shorts remain intact – diagonal option strips to serve both speculation and hedging

Thursday, December 31, 2015 7:45 AM UTC

Editor's Picks

- Market Data

Most Popular