We recommend a short NZDUSD trade as the pair going into the RBNZ meeting on 9 December 2015, the RBNZ is likely to deliver a 25bp cut. The market is hardly priced in upon a probability of a 25bp rate cut.

We think the NZD will likely sell off if RBNZ indeed eases. RBNZ may express discomfort with the recent strengthening of the NZD TWI, and could talk down the currency by warning of more rate cuts if the NZD strengthens further.

The RBNZ on this Thursday is barely estimated to cut rates for the fourth time this year, lowering the cash rate by 25bp to 2.5%.

This would fully reverse last year's rate hikes. We expect a cut given a weaker outlook and with average underlying inflation remaining below the RBNZ's target.

That said, we acknowledge that the RBNZ might want to extend its pause to gather more information on the economy, particularly when one of its key underlying inflation measures is tentatively picking up for the first time in several years.

In terms of the RBNZ's updated outlook, we think the forecast profile will build in a further cut next year, as well as a weaker exchange rate. We recommend being short NZDUSD going forward.

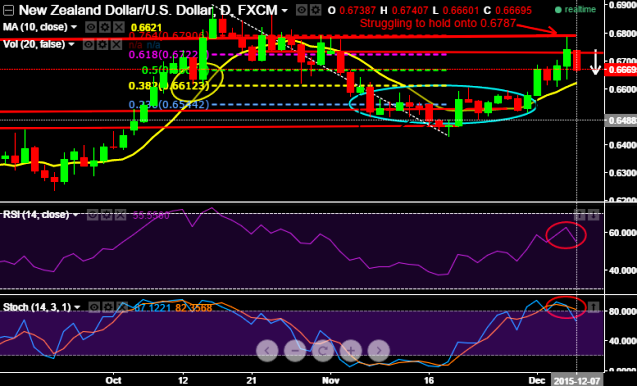

From a technical perspective, we are overall bearish on NZDUSD as the pair is struggling to clear 0.6787 (i.e. 76.4% fibo levels) and would prefer to use any abrupt upticks within range as an opportunity to sell at better levels.

RSI on daily chart is converging to the dips at 55 levels, while an attempt %D line crossover on slow stochastic curve above 80 levels which is oversold zone signals weakness.

Currently, %D line trending at 82.0686 and %K line at 66.2577 while articulating).

Nearby selling interest is expected in the 0.6800 area, with a confluence of resistance near 0.6900 helping to keep the greater focus lower.

A move below 0.6430 would encourage our bearish view towards initial targets near 0.6215. Our aggressive bearish stances are destined for the 0.5900 areas.

FxWirePro: NZD/USD yet to factor RBNZ rate cut, Kiwi dollar seems weaker again

Monday, December 7, 2015 12:08 PM UTC

Editor's Picks

- Market Data

Most Popular