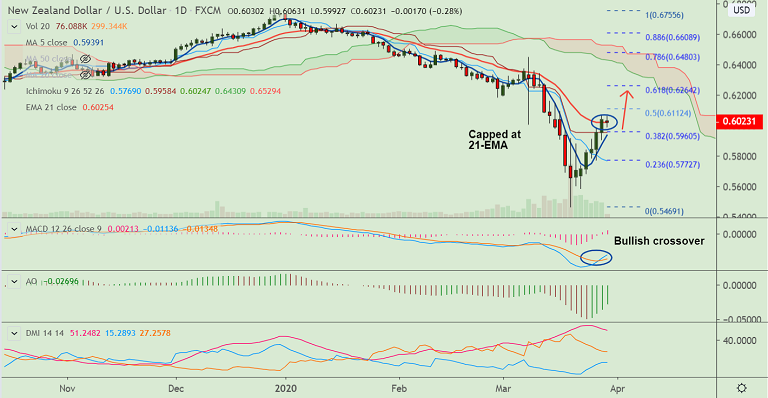

NZD/USD chart - Trading View

NZD/USD trades comatose around 21-EMA resistance, technical bias still supports upside.

The major was trading 0.26% lower at 0.6024 at around 04:00 GMT, with session highs at 0.6063 and lows at 0.5992.

Market’s risk-tone remains under pressure. PBoC's rate cut and the liquidity injection have failed to put a bid under the risk assets.

US dollar is drawing safe-haven bids, while the Kiwi under pressure after RBNZ indicated readiness to take further measures to combat the COVID-19 pandemic.

The Reserve Bank Of New Zealand (RBNZ) said the central bank has other tools on hand to keep cost of borrowing low for as long as needed.

NZD/USD has paused 6-day winning streak. But, technical indicators still support upside. Major trend is bearish, but break above 21-EMA could see more upside momentum.

'Death Cross' (bearish 50-DMA crossover on 200-DMA) to limit upside. Rejection at 21-EMA will see downside resumption.

No major data/events scheduled for the day. Focus remains on the virus/stimulus news for direction.

Major Support Levels - 0.5960 (38.2% Fib), 0.5938 (5-DMA)

Major Resistance Levels - 0.6025 (21-EMA), 0.6112 (50% Fib)

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges