We project Kiwis dollar to drop over the next year or so, as the growth will likely continue to underperform the RBNZ’s lofty forecasts (refer above chart), and as tight financial conditions restrain any requirement for OCR hikes, allowing rate compression vs USD.

While still expecting depreciation, we are raising our sights by a few percent on NZDUSD, as a benign global economic backdrop and persistent weakness in the USD are incentivizing carry and boosting the performance of commodity exporters.

Thereby, we maintain the 4Q’17 target is 0.70 (previously 0.67), and our 2Q’18 target is 0.66 (previously 0.64).

The NZ data have underperformed significantly (refer above chart), and NZD rates have compressed to remove much chance of rate hikes within the next year.

But stability in policy rates appears to be enough to keep higher yielding FX out-performing, atleast until the FX rate becomes a genuine problem for the central bank.

Hedging framework:

OTC Outlook and Options Trade Recommendations:

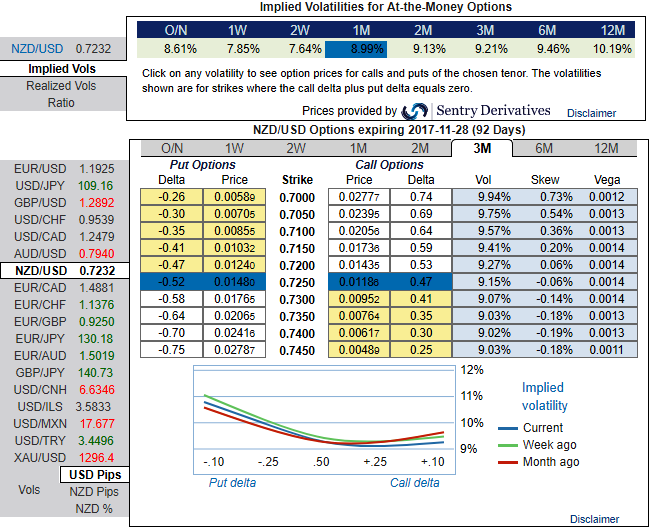

All the factors stated above seem to be discounted in FX options market, please glance through nutshell evidencing IV skews that signify hedger’s bearish interests in next 3-months timeframe. Positively skewed IVs of this tenor signal underlying spot FX is expected to be either edgy with sideways swings or lowering southwards as the skews have been well balanced flashing positive numbers on both OTM and ITM strikes.

By now, writing 1m (1%) in the money put would have fetched us handsome yields snapping rallies upto 0.7558 levels in form of initial option premiums received. You could easily make out short legs on ITM puts of narrowed expiries are going worthless as anticipated. For now, we uphold longs in 3m at the money put, the structure could be constructed at the net credit.

Upon the mounting bearish risk sentiments are observed as you could see the positively skewed IVs in OTM put strikes of 1m tenors (refer positive IV skews indicate the strikes towards 0.70 which is our forecasts).

The combination of IV 1-3m skews suggested credit put spreads that has favoured to arrest ongoing upswings in short run and bearish risks are to be taken care by 3m ATM longs.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -116 levels (which is highly bearish), while hourly USD spot index was flashing at -71 (bearish) at the time of articulating (at 08:03 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential