NZD has actually performed better than expected over 4Q’2018, as a rebound in domestic activity data offset global drags on high beta FX. Still, it is reckoned that the global risks play less favorably for NZ than they do for Australia, and the central bank has reason to be credibly dovish even as the data have outperformed some of the downside risk scenarios laid out earlier in 2018. NZD is expected to depreciate to 0.61 levels by year-end.

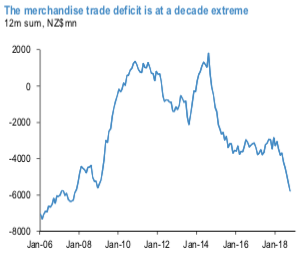

In contrast to Australia, where the export-relevant commodity markets are already tight, New Zealand’s agricultural exports are subject to both a negative demand shock (China), and a loss of market share (negative domestic supply shock with rising global supply). Dairy prices have weakened, dragging the trade balance to the widest deficit in a decade (refer above chart). While the fall in oil prices will likely offer some reprieve, exports remain constrained and are unlikely to benefit from a redistribution of China’s GDP growth toward fixed asset investment.

There were clear domestic drivers of NZD’s slide over the majority of 2018. Growth was weak over the first half of the year and has clearly has slowed relative to the bullish rates that prevailed at the immigration peak over 2014-16.

The broad-based USD seemed to have been tweaked lower on a less hawkish Fed, but still pencils in modest strength for 2019. Fed is scheduled for its 1stmonetary policy of 2019 this week (on 30thJanuary) which is likely to maintain a status quo.

The surprising development has been the speed with which US data came off the boil focusing risk markets on rising recession risks and prompting a slide in US equities and pushing the Fed to adopt a more dovish stance as well. But the economists took this on board and not disregarding two rate hikes in 2019.

And in contrast, even as the NZ data rebounded over the latter part of 2018, Governor Orr declared that the OCR will need to be on hold until 2020 in order to sustainably hit the inflation target.

Hence, for those we foresee the long-term exposures, shorting futures of mid-month tenors have been advocated in the past with a view of arresting further potential slumps, we wish to uphold the same positions. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index:FxWirePro's hourly NZD spot index is inching towards 79 levels (which is bullish), while hourly USD spot index was at -76 (bearish) while articulating (at 06:56 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand