- NZD/USD trades largely muted around major trendline support at 0.72 levels, intraday bias bearish.

- The pair edged higher from 3-week lows at 0.7167 hit on Tuesday after USD dented post Yellen's speech.

- Yellen said that uncertainties strengthen the path of gradual rate hikes, while considerable odds won't stabilize inflation at 2% over next few years.

- Ongoing political uncertainty will however cap upside in the pair. Technical indicators are also bearish.

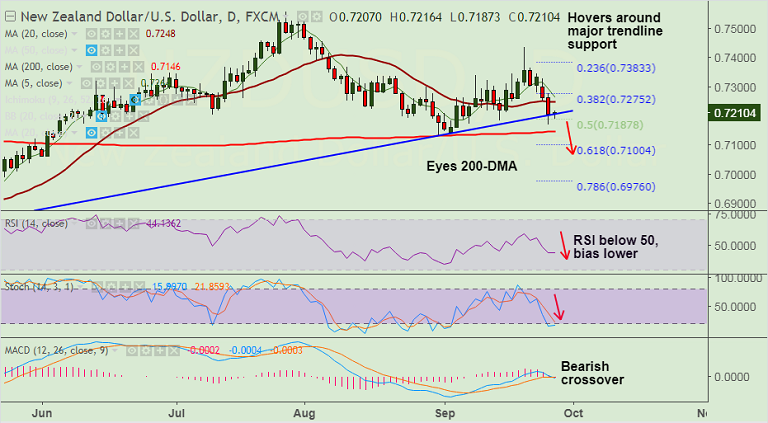

- RSI is below 50 levels and biased lower, Stochs point south. MACD shows bearish crossover on signal line.

- The pair has broken below 20 and 100 DMAs and now finds next support at 0.72 (trendline).

- Break below trendline will see drag lower, test of 200-DMA at 0.7146 then on cards.

- On the flipside, retrace back above 20-DMA at 0.7248 will invalidate our bearish call.

Support levels - 0.72 (trendline), 0.7187 (50% Fib retracement of 0.68176 to 0.7558 rally), 1.7245 (200-DMA)

Resistance levels - 0.7239 (100-DMA), 0.7248 (20-DMA), 0.7275 (38.2% Fib retracement of 0.68176 to 0.7558 rally)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-USD-holds-20-DMA-support-at-07250-good-to-go-short-on-break-below-915862) has hit all targets.

Recommendation: Book partial profits at lows. Hold for test of 200-DMA at 0.7145

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest