NZD/USD chart on Trading View used for analysis

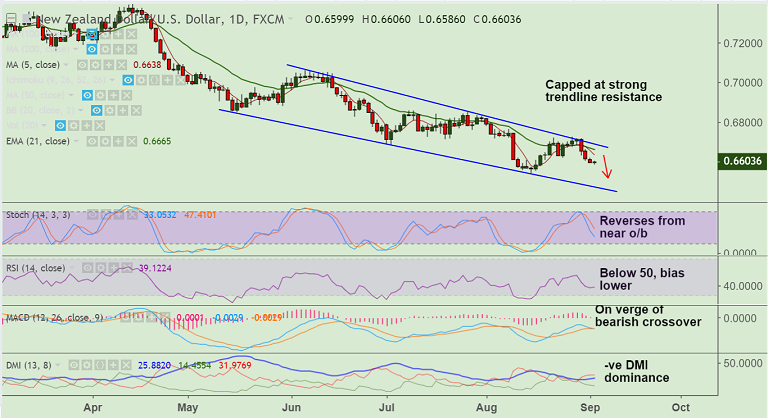

- Major and Minor Trend in the pair remain Bearish.

- Kiwi bears firmly in control, NZD/USD targets trendline support at 0.6475.

- Data released by the Statistics New Zealand on Monday showed NZ Terms of Trade Index improved to 0.6% in Q2 from -2% in Q1, but fell short of the market expectation of 1%.

- There is now a growing conviction among markets that the next RBNZ policy move will be a cut - rather than a hike.

- GDT auction will be watched closely by the participants. In the U.S. economic docket IBD/TIPP Economic Optimism Index and the ISM and Markit Manufacturing PMI figures will be in focus ahead of the crucial emplyment data on Friday.

- Technical studies are bearish. Pullback ran ot of steam at 21-EMA, pair has resumed weakness and is curently hovering around 0.66 handle.

Support levels - 0.66, 0.6544 (Aug 15 low), 0.6475 (trendline)

Resistance levels - 0.6637 (5-DMA), 0.6665 (21-EMA), 0.67

Call update: Our previous call (https://www.econotimes.com/FxWirePro-NZD-USD-Trade-Idea-1423280) is progressing well.

Recommendation: Hold for targets.

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -3.24093 (Neutral), while Hourly USD Spot Index was at 75.4558 (Neutral) at 0615 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.