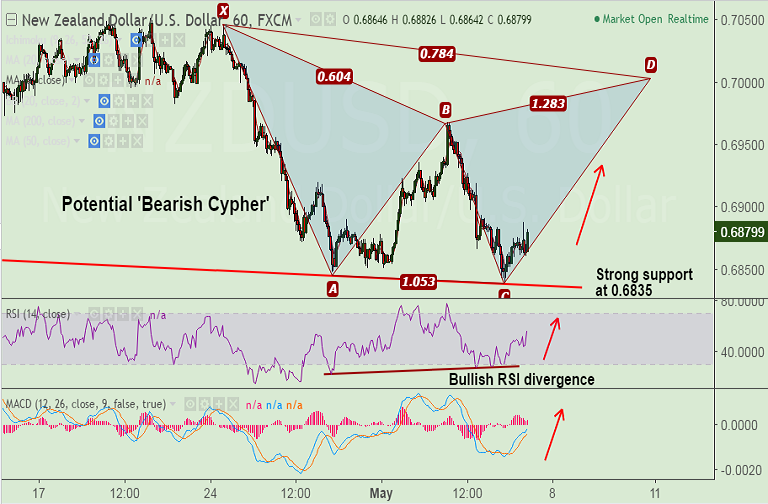

- NZD/USD potential 'Bearish Cypher' and bullish RSI divergence provide signals for some upside.

- The major has failed to hold gains above 20-DMA on Wednesday's trade and slumped to fresh 11- month lows of 0.6839.

- The pair has held trendline support at 0.6940, break below will likely see drag upto monthly 200-SMA at 0.6808 levels.

- On the upside break above 1H 200-SMA at 0.6902 could propel the pair to 0.6988 (50-DMA) and then 0.70 levels.

Support levels - 0.6840 (trendline), 0.68 (monthly 200-SMA), 0.6780 (trendline),

Resistance levels - 0.6895 (5-DMA), 0.6902 (1H 200-SMA), 0.6952 (20-DMA), 0.6988 (50-DMA)

TIME TREND INDEX OB/OS INDEX

1H Bullish Neutral

4H Bullish Neutral

1D Neutral Neutral

1W Bearish Neutral

Recommendation: Good to go long on dips around 0.6870, SL: 0.6830, TP: 0.69/ 0.6950/ 0.6988

FxWirePro Currency Strength Index: FxWirePro's Hourly NZD Spot Index was at -17.173 (Neutral), while Hourly USD Spot Index was at 23.0676 (Neutral) at 0650 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.