FxWirePro: NZD/USD edges lower from session highs at 0.6750, good to sell rallies

Wednesday, March 9, 2016 5:13 AM UTC

- Kiwi unable to extend gains beyond 0.6819 and is extending downside for the third consecutive session.

- Renewed bout of risk-aversion hit markets after the PBOC slightly devalued yuan today after three back-to-back sessions of gains.

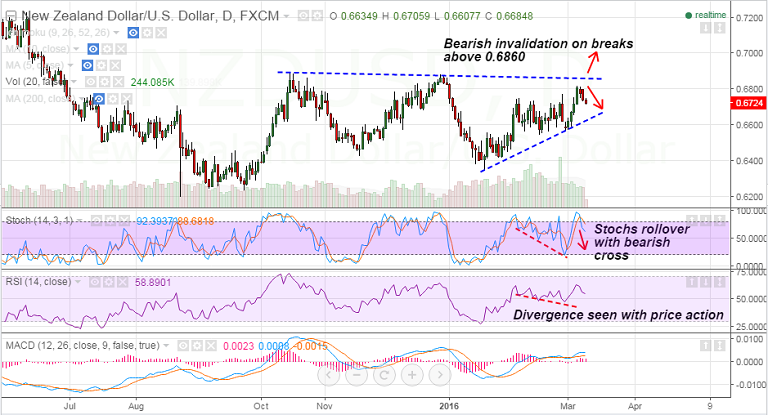

- Technicals indicated downside for the pair:

- We see divergence between price action and momentum indicators - Stochastics and RSI

- Stochs have rolled over from overbought levels with a bearish crossover

- RSI is biased lower

- Chinese CPI figures and the RBNZ policy decision due later this week will have a major impact on the pair.

- Higher-yielding currencies like the Kiwi to struggle as sentiment remains weak and oil is seeing renewed downside.

- We see the pair test trendline support at 0.6635 and further weakness could see 0.6565 levels.

- Supports on the downside are aligned at 0.6713 (Mar 4th lows), 0.6700, 0.6630 (rising trendline).

- On the upside resistances are seen at 0.6750 (session highs), 0.6756 (Mar 3rd high), 0.6775 (Feb 26th high).

Recommendation: Sell rallies around 0.6735/40, SL: 0.6820, TP: 0.67/0.6655/0.66